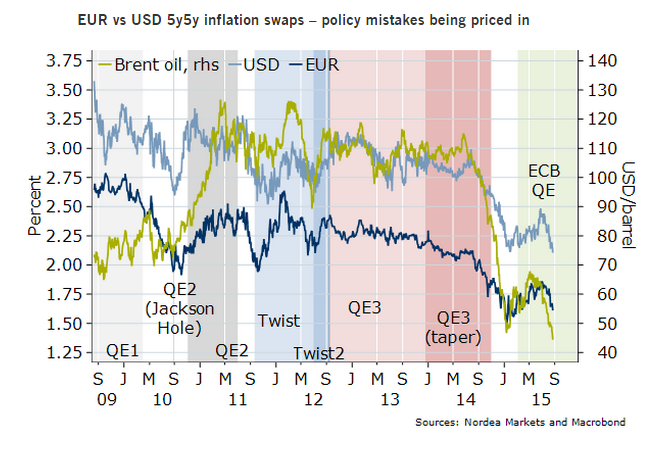

The ECB is faced with: i) a substantially stronger euro than expected, ii) inflation expectations are much below mandate-consistent levels, iii) oil prices are 31% lower than ECB expected in July, iv) GDP growth is looking a tad wobbly, and v) a market that is pricing in four successive deflation readings in coming months. The ECB will need to cut its inflation forecasts materially, which raises hopes for (EUR-negative) stimulus up ahead of the Sept meet.

In the euro area a number of prominent ECB members on the wires this week:

Tuesday: ECB Vice President Constancio speaks on 'Effects of non-standard monetary policy measures" in Mannheim, Germany (11:40 London time).

Wednesday: ECB Executive Board Member Praet speaks on "The Euro crisis and the role of different economic traditions' in Mannheim, Germany (11:40 London time).

Thursday: ECB Executive Board Member Coeure speaks at conference in Paris. (12:00 London time).

Their comments will be followed closely as the drop in the oil price is threatening the ECB's outlook for higher inflation and market-based 5Y5Y inflation expectations have declined below 1.7%. Around a year ago ECB president Draghi expressed concern when 5Y5Y inflation expectations declined below 2.0% and the latest decline could very likely result in a more dovish tone from the ECB.

With inflation so close to zero and several worrying signs from the world economy, this week's data will be interesting. After the surprising rise in July, the German Ifo index (0800 GMT Tuesday) is expected to fall slightly, driven mainly by China-related worries. Apart from that, Germany and Spain will be the first Euro countries to publish preliminary inflation prints for August.

"China and EM fears is currently triggering massive de-risking in global markets, leading to a substantial squeeze higher in EUR/USD. Inflation markets are currently screaming for both ECB and Fed to ease further. To us it makes sense for the ECB to "outdove" the Fed, but that depends on how much the central bank has changed under Draghi," Nordea Bank said in a report to its clients.

The single currency had set a seven-month peak of $1.1715 on Monday on panic triggered by China's stock markets crash. After bottoming out in the 1.1520 region, EUR/USD has managed to regain the 1.1560/70 band on the day.

Oil price drop threatening ECB’s outlook for higher inflation, raising likelihood of a more dovish ECB

Tuesday, August 25, 2015 7:14 AM UTC

Editor's Picks

- Market Data

Most Popular

Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances

Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances  PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters

PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters  Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists

Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists  Australian Central Bank Signals Tough Stance as Inflation Pressures Persist

Australian Central Bank Signals Tough Stance as Inflation Pressures Persist  RBA Raises Interest Rates to 3.85% as Inflation Pressures Persist

RBA Raises Interest Rates to 3.85% as Inflation Pressures Persist  Japan Signals Openness to Gradual BOJ Rate Hikes as Deflation Era Ends

Japan Signals Openness to Gradual BOJ Rate Hikes as Deflation Era Ends  Bain Capital Secures RBI Approval to Acquire Up to 41.7% Stake in Manappuram Finance

Bain Capital Secures RBI Approval to Acquire Up to 41.7% Stake in Manappuram Finance