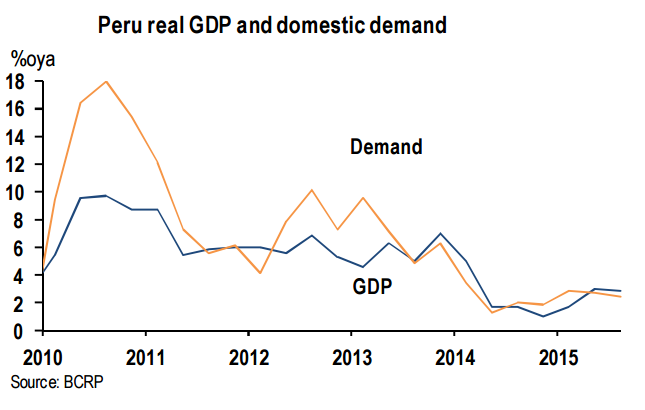

Peru's GDP grew 2.9%oya in 3Q15, virtually unchanged from the 3.0% growth in 2Q. On a sequential basis, activity slowed to 2.7%q/q, saar in 3Q from 3.6% in 2Q, pointing to stabilization ahead. On a year-to-date basis the economy is running at 2.6%oya, and economic activity seen accelerating to 3.3%oya in 4Q15, which is consistent with the 2.7% full-year 2015 GDP growth forecast. Domestic demand growth throttled back to 2.5%oya in 3Q, from 2.7% in 2Q, due to a slowing in consumption and decline in investment. Stronger public spending, stabilization in private consumption, and increasing investment is expected to underpin a growth pickup toward 3.2% in 2016.

Looking at the GDP breakdown, private consumption, the main pillar of growth, increased by 3.4%oya in 3Q, about unchanged from its pace in 2Q, to contribute 2.1%-pts to oya real GDP growth in the quarter. Meanwhile, government spending moderated to 4.2%oya in 3Q from 9.1% in 2Q, contributing 0.5%-pt to GDP growth. On the other hand, investment continues to fall, but appears to have bottomed, contracting 4.5%oya in 3Q, after a 9.3% nose-dive in 2Q. The annual contraction reflects a 3.7%oya decline in private investment 3Q after an 8.8% fall in 2Q and a 7.8%, drop in public after a 11.6% slump in 2Q. The capex contraction subtracted 1.2%-pts from real GDP growth in 3Q. On the external front, net exports contributed 0.4%-pt in 3Q, driven by 0.1%oya drops in both exports and imports.

While the timing and pace of recovery in private investment remains uncertain, public investment is expected to pick up as the government compensates for the inefficient implementation of the fiscal stimulus programmed for this year.

Peru’s domestic demand is stabilizing

Tuesday, December 1, 2015 10:44 PM UTC

Editor's Picks

- Market Data

Most Popular

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient