The Mexican peso has touched record lows Tuesday against the greenback, amid an environment of growing anxiety over the United States Presidential Debate between Democratic candidate Hillary Clinton and Republican Donald Trump. Also, recovery of the currency seems limited in the short-term.

Currency traders have been holding up bearish positions as pre-election polls showed that Hillary Clinton’s lead has been narrowing as against her Republican counterpart. The USD/MXN pair has been trading the worst as compared to other currency pairs over the last one month as Clinton pledged to re-negotiate the 20-year old NAFTA that helped Mexico become an export-oriented economy.

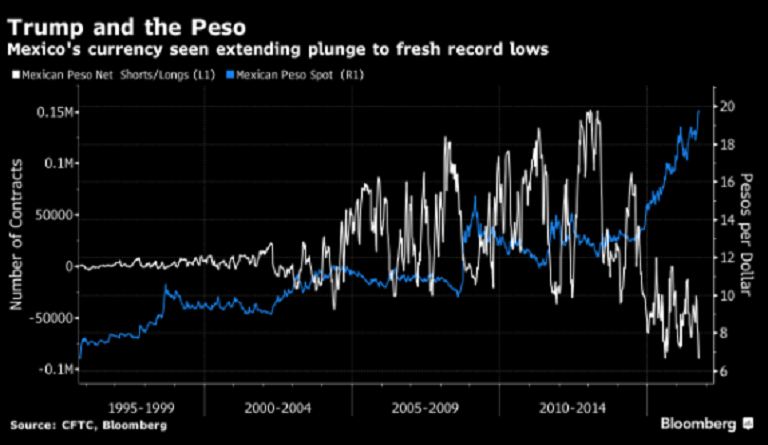

Net short positions on the peso jumped 37 percent in the week ending Sept. 20 and are now the highest in more than 20 years of data, according to the Washington-based Commodity Futures Trading Commission. One-month implied volatility, a measure of the cost to protect against price swings, rose to 19 percent Monday, the highest in the world, Bloomberg reported.

Meanwhile, Mexico's 2017 budget presented to Congress recently has an overall public sector deficit target of 2.9 percent of the gross domestic product (the deficit was 4.1 percent of GDP last year) with total revenues rising by 0.4 percent in real terms with an expected 16 percent drop in oil receipts offset by a 10 percent rise in non-oil revenues.

"If he does well today and polls continue to go in his favor, that would probably mean a more depreciated peso," Bloomberg reported, citing Carlos Capistran, Chief Mexico Economist, Bank of America Corp.

At 7:20GMT Tuesday, USD/MXN was trading 2.15 percent down at 19.45, against previous close of 19.88.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength