Property is a fundamental driver for China’s economy and the nation has become over-reliant on the property market for economic growth over the past decade. Despite series of government measures aimed at stemming speculative demand and restraining price hikes, overheating in first-tier and some second-tier cities remained unsolved.

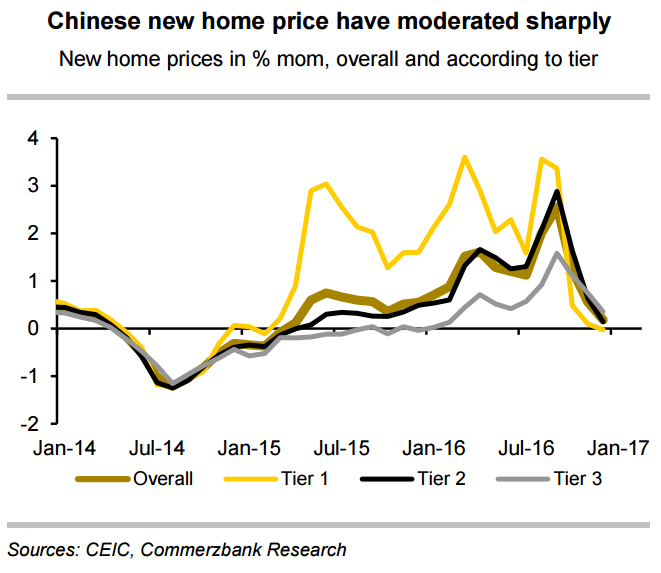

Average new home prices in 70 major cities rose 12.4 percent in December from a year earlier, compared to November's record 12.6 percent rise, data from the National Bureau of Statistics(NBS) showed on Wednesday. On a monthly basis, new home prices rose 0.3 percent, slowing from November's 0.6 percent, according to Reuters calculations.

Prices of new homes in China increased last year at the fastest rate since 2011. In Shenzhen, Shanghai and Beijing, prices rose more than 20 percent from 2015, but increases moderated in December on a monthly basis. China home prices increased last month in the fewest cities since January last year, signaling property curbs to deflate a potential housing bubble are taking effect.

“Overall the market is cooling down, even as sales volumes didn’t contract as much as we expected. It will take time, probably several months, for buyers to feel the gradual crunch of liquidity.” said Alan Jin, a property analyst at Mizuho Securities Asia Ltd. in Hong Kong.

Property prices in big cities have severely diverged from their real value. Disproportionately high prices have raised the fear of bubbles in the economy. Authorities are pledging prudent and neutral monetary policy and greater focus on deflating asset bubbles as they work to ensure stability.

"The government should strengthen price controls on commercial housing to prohibit exorbitant profits by executing a price cap on new houses, which should be calculated by adding reasonable profits, say at maximum 20 percent, to costs," said Tang yuan, department chief at the Policy Research Office of the State Council.

PBOC set Yuan mid-point at 6.8525/ dollar vs last close 6.8501. Chinese yuan edged lower in early hours of Asia after lower than expected house price data. USD/CNY made intraday high at 6.8658 and low at 6.8402 levels. FxWirePro's Hourly Yuan Strength Index remained bearish at -79.676 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality