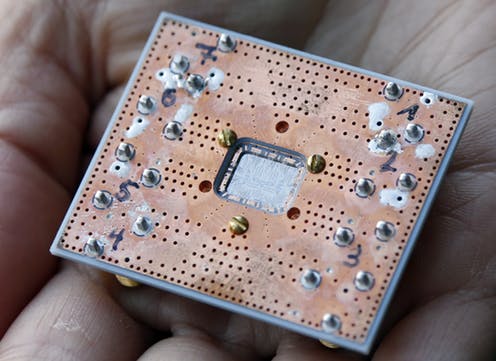

Quantum computing startup PsiQuantum is raising at least $750 million at a $6 billion pre-money valuation, with BlackRock reportedly leading the round, according to sources familiar with the matter. The funding aims to support PsiQuantum’s ambitious plan to mass-produce quantum chips using photonics-based semiconductor manufacturing.

Unlike competitors relying on exotic materials, PsiQuantum leverages traditional photonics technology—commonly used in fiber-optic internet connections—at GlobalFoundries’ New York facility. The company plans to scale production to millions of quantum chips, a costly endeavor requiring significant capital.

Quantum computing promises to solve problems far beyond the capabilities of today’s machines, such as simulating atomic interactions for drug discovery or advanced materials. Big tech players like Google, Microsoft, Amazon, and Nvidia are racing to develop quantum technologies. Just last week, Nvidia announced a quantum research hub in Boston, highlighting the sector’s growing momentum.

PsiQuantum is also collaborating with the U.S. and Australian governments to build two quantum computers—one in Brisbane and another in Chicago. While quantum computers have existed for decades, high error rates have limited their practical use. However, recent breakthroughs in quantum error correction and chip design are bringing commercial viability closer.

PsiQuantum projects it could deliver a useful quantum machine by 2029 or sooner, while Google targets real-world applications within five years. As competition intensifies, PsiQuantum’s photonics-based approach and deep-pocketed backers position it as a strong contender in the quantum race.

With major investments and partnerships, PsiQuantum is on track to play a critical role in shaping the future of quantum computing—an industry poised to redefine scientific discovery, pharmaceuticals, and energy innovation.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services