The Reserve Bank of Australia (RBA) left the cash rate unchanged at 1.50 percent at its board meeting today as widely expected by the markets. The central bank has ignored accumulating evidence of a likely softness in Q1 GDP data and judged steady policy is consistent with growth and inflation targets. The Bank remains upbeat on the global outlook, domestic business conditions, and non-mining investment outside the regions impacted by the mining downturn.

The current account data published this morning does not bode well for growth in Q1. Australia’s current account deficit was much larger than expected in Q1, narrowing slightly to AUD3.1bln from a downwardly revised 3.5bln in Q4 2016. The volume of exports dipped by 1.6 percent in Q1, largely driven by a decline in resource exports. Net exports likely to have subtracted 0.7ppt from Q1 GDP growth.

The central bank has, in its previous meetings, highlighted two key factors warranting close attention - the labour market and the housing market. The RBA remained cautious about the labour market, noting that employment growth was “stronger over recent months” but that growth in “total hours worked remains weak”. With regards to the housing market, the RBA notes that “there are some signs that these conditions are starting to ease” but it is too early for the RBA to relax on the risks associated with the housing market and high household debt.

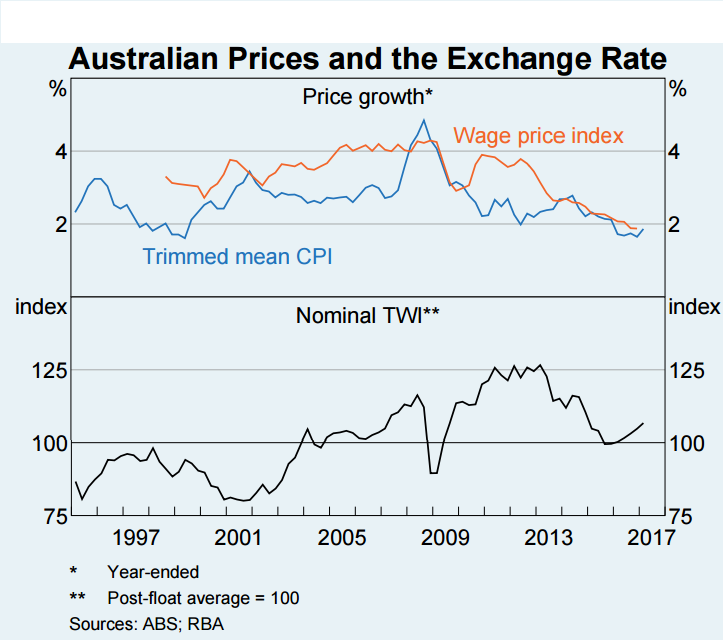

Inflation at 2.1 percent has recently reached the RBA’s target band, although core inflation continues to lag slightly. Even though inflation returned into the RBA's target range of 2-3 percent in Q1, the 2.1 percent domestic demand is still not satisfactory. That said, the external environment is looking supportive, commodity prices are consolidating with scope to rally, and China is stabilising from its recent data dip. Analysts opine that at this stage, the central bank is in no hurry to move rates in either direction.

"The RBA does not appear likely to be moving official interest rates anywhere in a hurry. While the concerns regarding high household indebtedness and the housing market remain, we expect the RBA will leave official interest rates on hold," said Janu Chan, Senior Economist at St George Economics.

AUD/USD stalled disappointing current account data-led slide near 0.7460-55 region and edged higher after RBA policy announcement. AUD/USD has bounced of major trendline support at 0.7370 levels, broken above 20-DMA and bulls now target 200-DMA at 0.7531. Technical indicators are biased higher, we see weakness only on close below 20-DMA at 0.7436. The pair is currently struggling at 50-DMA, break above confirms further upside.

FxWirePro's Hourly AUD Spot Index was at 65.9602 (Neutral), while Hourly USD Spot Index was at -76.0693 (Neutral) at 1100 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm