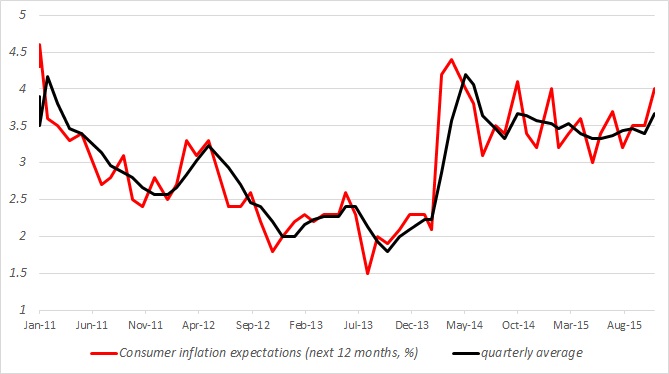

To add to the headache of Reserve Bank of Australia's (RBA) policymakers, who are trying to tame slowdown using loose monetary policy at one hand, facing real estate price hike and deteriorating terms of trade at the other, inflation expectations among consumers rose to 14 month high.

RBA has kept policy steady and interest rate at 2%, facing pressure from a real estate bubble feeding from low exchange rate and interest rates, now faces rising inflation expectations, which at latest survey in December rose to 4%.

Though, outstanding loans made for investment purpose are down by $3.5 billion since April, it is still at quite a high at $11.5 billion, compared to just around $6 billion in 2011/12.

Weaker Aussie, other than providing support to exporters in the commodity segment, having some side effects too. It is contributing to worsening of terms of trade as well as feeding into inflation.

With above view, we expect RBA to hold policy steady into first half of 2016, unless major hard landing occurs in China.

Aussie is strong today, thanks to robust employment, which rose by 71,400, pushing unemployment lower to 5.8%, despite 0.3% rise in participation.

Aussie is currently trading at 0.729 against Dollar.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX