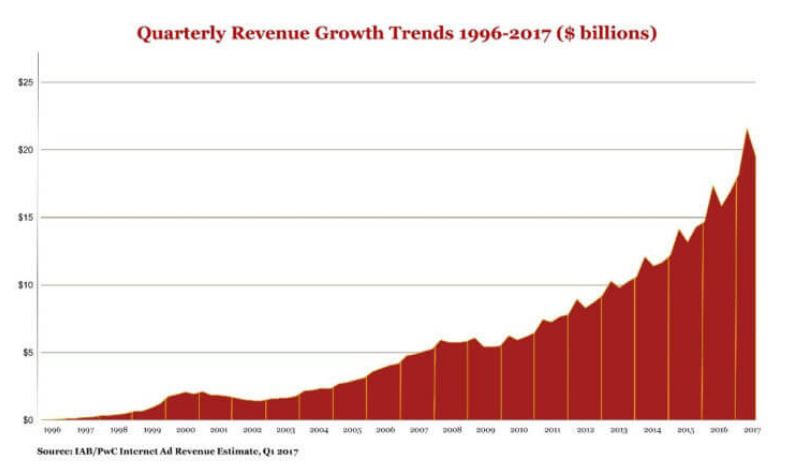

Revenues generated from digital advertisements in the United States have increased to $19.6 billion (up 23% y-o-y) for Q1 2017. This remarkable growth rate marks the 7th quarter on the trot that digital marketing revenues have increased so robustly. The information was released by Interactive Advertising Bureau (IAB) for the first quarter of the year. According to the data, digital advertising revenues in the US are on the ascendancy, and the trends are projecting stronger growth in Q2 2017.

Price Waterhouse Coopers (PWC) confirmed the data, and this marks the second-best performance of digital advertising revenues in the US on record. Prior to that, the best quarter ever experienced by digital advertising marketing was in Q4 2016 when $21.6 billion was generated. PWC partner, David Silverman believes that interactive advertising is attracting scores of customers across the board.

Back in 2016, the Interactive Advertising Bureau (IAB) reported that smartphone, tablet and phablet devices accounted for the majority of all online advertising revenues in the United States at 51%. This marked the first time in the history of digital advertising that mobile overtook desktop and PC devices as the #1 most popular medium for reaching customers.

Google and Facebook Dominating Digital Ad Market

In 2016, the total value of online advertising revenues increased as much as $72.5 billion, up $12.9 billion from the 2015 figure. Naturally, the heavy hitters of the industry are companies like Facebook and Google, accounting for the majority (85% +) of all online digital advertising in the United States.

It is interesting to point out that Facebook’s year on year growth in digital advertising outstripped that of Google by a long margin. Between 2015 and 2016, Facebook enjoyed a 62% year on year growth rate in digital ads, compared to a 20% increase for Google between 2015 and 2016. All other industry players enjoyed rather lackluster improvements of just 9% between 2015 and 2016. The rapid growth and development of digital advertising is evident in the number of new entrepreneurial ventures that are enjoying phenomenal success.

One of these ‘disruptive’ business leaders is Sam Ovens tech entrepreneur. This New Zealander amassed a multimillion dollar fortune by ditching a dead-end job and turning to digital advertising as his bread-and-butter. He followed in the footsteps of many other tech moguls like Bill Gates, Mark Zuckerberg, Michael Dell, Steve Jobs, Jack Dorsey, Paul Allen, Larry Ellison, Sean Parker, Evan Williams and company who dropped out of college, or never even attended in the first place.

Where to Next for Digital Advertising?

Ten years ago, online advertising was comprised of nothing more than a text ad, or a basic banner on a website. However, the rapid growth and development of the Internet of things, and specifically mobile technology has facilitated a paradigm shift in the way companies market their products to clients. For 2017, it is expected that the total value of US digital advertising will surpass $83 billion. This is phenomenal, and represents one of the fastest growing markets of all tech-related industries.

The mobile ad revenues generated by companies like Google, Facebook, Yahoo, Twitter and to a lesser degree Pandora have been increasing rapidly since 2016. For 2017, Google is expected to account for 32.4% of all US mobile ad revenue, Facebook 24.6%, Yahoo 2.3%, Twitter 2.0% and Pandora 1.7%. By 2019, Google’s total percentage of mobile ad revenues in the US will account for 33.8% of the market, Facebook 26.5%, and Yahoo will likely decrease to 2.0%.

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports