Latest data shows that hot money outflow from China continued in September.

- As of data from Peoples Bank of China (PBoC), China's FX reserve sank by another $43 billion in September. This downfall in reserve came in the back of large trade surplus and positive foreign direct investment suggesting capital account outflow could be as high as $100 billion.

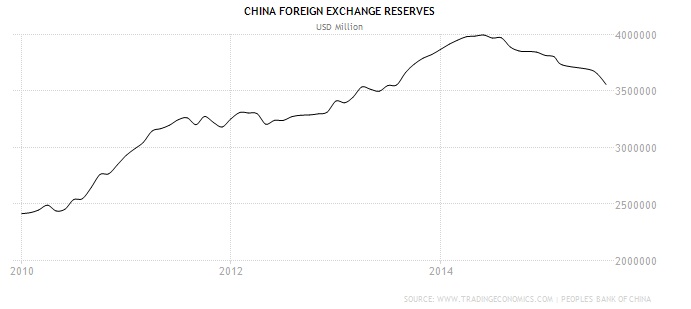

- In August. FX reserve dropped by $94 billion, sharpest monthly fall on record. China's FX reserve peaked in June 2014 almost at $4 trillion and from there in little more than a year, it has now fallen to $3.514 trillion, lowest since July 2013.

Forex reserve has declined so far in every month this year, except for April and is now declining at an average pace of $36.5 billion per month.

In August PBoC devalued Yuan via fix by as much as 2%, which led to massive market turmoil in August. An estimated $130 billion might have flown out of China in August, compared to that pace has greatly reduced in September. Still far from stabilizing.

While China has enough firepower to maintain a de-facto peg with Dollar against Yuan, which is currently trading at 6.35 (USD/CNY). Yuan has actually appreciated from 6.45 in August. If flow data shows no reversal in outflow in October, appreciation suggests PBoC's invisible hand in play.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand