The Reserve Bank of Australia (RBA) will continue to remain on hold at Tuesday's board meeting where the official cash rate will remain parked at 1.5 percent. Future markets have priced in only a 2 percent chance of a cut and no chance of a rise. The RBA has expressed an unwillingness to lower official interest rates further, given the financial stability risks associated with the housing market and high household debt levels.

The central bank also remains caught between underlying inflation that is below target and reaccelerating house prices. With economic growth under its potential and inflation below the target band, the RBA has left the door to an interest rate cut ajar. There are growing doubts about the ability of labour market growth to boost wages growth and inflation.

Capital city dwelling prices across Australia rose by 1.4 percent for the second consecutive month in March. Growth in house prices has outpaced that of unit prices over the year to March. Nationally house prices rose 13.4 percent, outpacing growth in unit prices of 9.8 percent.

The Australian Prudential Regulation Authority (APRA) has again tightened measures on investor lending, albeit rather lightly. The measures are designed to ensure financial stability and are likely to result in a slowing in investor activity and a moderation in house price growth, over time. If measures from APRA are successful in lowering financial stability risks, in time it could potentially lower the hurdle for an interest rate cut from the RBA.

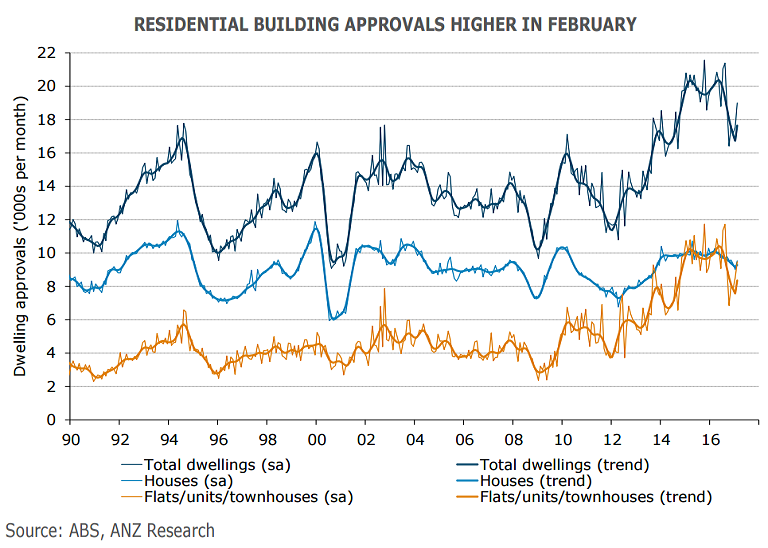

Building approvals posted a strong increase in February, beating expectations of a decline. House prices were up strongly in March, yet again. Detached housing approvals were up 5.7 percent m/m, reversing two months of falls. The CoreLogic capital city house prices rose 12.9 percent y/y in March compared with 11.7 percent y/y in February. This is the strongest annual price growth since the first half of 2010. Data suggest house price growth has not yet peaked, despite the efforts of the regulators.

"RBA will leave its key rate unchanged tomorrow morning. Rising property prices are worrying the Australian central bankers but are unlikely to cause any measures any time soon," said Commerzbank in a report.

AUD/USD is extending its three-day losing streak after the Aussie remains dented by worse-than-expected Australian retail sales data. The pair is currently holding strong trendline support at 0.76 levels. Technical indicators support downside, RSI and Stochs are biased lower. Price action has broken below 50-DMA and is on track to test 200-DMA at 0.7551.

FxWirePro's Hourly AUD Spot Index was at -41.0664 (Neutral), while Hourly USD Spot Index was at 98.8031 (Bullish) at 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons