Euro has taken support around 1.113 against dollar as bund yields have started rising across the curve.

Bund continue to trade in high volatility and heavy intraday price swings as hedge funds seen reversing their one sided bet to short the curve.

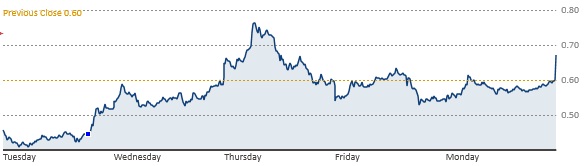

- German 10 year yield is up 9 basis points trading around 0.69%. Yield might look to challenge recent high around 0.75%. However bund price might face some challenge while going down as massive hammer candle developed last Thursday might prevent rapid fall. However fall would exacerbate should hammer low gets broken.

- Although higher end of the curve moving up much faster, shorter end is also not left behind. German 4 year yield is up almost 3 basis points looking to move to positive territory. As of now trading at -0.003%. German yield curve which went negative up to 9 years on April 17th is now negative only up to 4 years.

Euro bulls have broken above 1.12, taking cues from rising yield environment. Further rise is likely, however resistance around 1.129-1.132 would pose tough challenge.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand