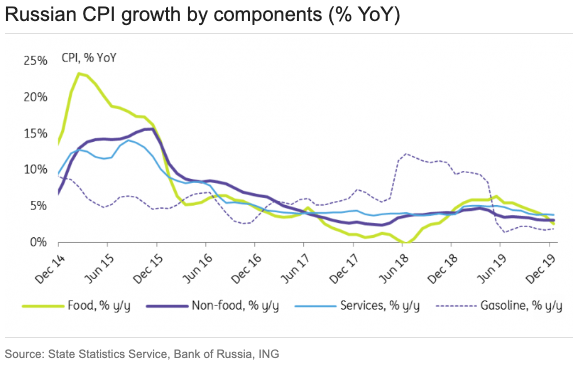

Russia ended 2019 on a disappointing note in terms of consumer price inflation (CPI), which dropped to 3 percent y/y, close to the Central Bank of Russia’s (CBR) lower target range and is expected to fall nearly to 2 percent on a temporary basis during the first quarter of this year, according to the latest research report from ING Economics.

Looking at the CPI composition, food products (38 percent of consumer basket) seems to be the sole disinflationary component, with food CPI slowing from 3.7 percent y/y in November to 2.6 percent y/y in December on a higher statistical base, while non-food CPI growth stayed unchanged at 3.1 percent y/y amid accelerating gasoline price growth, and services CPI decelerating only marginally from 3.9 percent y/y to 3.8 percent y/y.

Global grain prices, seem to be heading north again after showing a negative to flat y/y performance in the middle of 2019. Global wheat prices in US dollar terms were up 11 percent y/y in December 2019 and flattish in rouble terms, with roughly similar expectations for 1Q20, depending on RUB performance, the report added.

Inflationary expectations, as reported by the Bank of Russia, deteriorated in December both for households and corporates, which may suggest some reassessment of the CPI prospects after November's Black Friday promotional discounts.

In the meantime, the consumer sentiment index in December was reported at 95 points, which is 6 points higher than a year ago, while retail trade growth accelerated to 2.3 percent y/y in November, the highest level in 11 months, suggesting a lack of demand-driven constraints to CPI growth.

"While we agree that the likelihood of that scenario has increased, we still believe that the final decision will be a close call, and see the following arguments against a cut," ING Economics further commented in the report.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target