The manufacturing sector in Russia continued to strengthen on a surge in output growth and new orders. Backlogs of work accumulate at the quickest pace since August 2006.

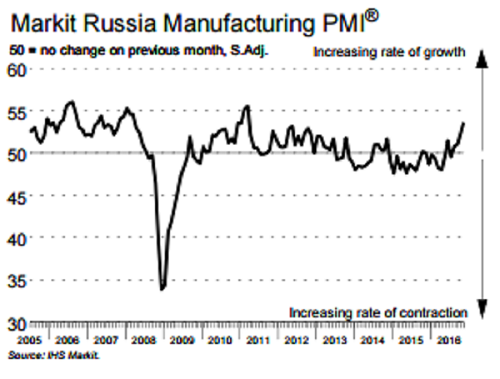

The seasonally adjusted Markit Russia Manufacturing Purchasing Managers’ Index (PMI) increased from October’s 52.4 to a 68-month high of 53.6 in November. The latest figure continued a four-month sequence of growth and indicated a solid overall improvement in the health of Russia’s manufacturing industry.

Output growth in Russia’s goods-producing sector accelerated to the quickest since March 2011, with the rate of expansion outstripping the historical average. Despite the rise in production volumes, Russian manufacturers recorded a further decline in their inventories of finished goods in November.

In line with the trend for production, new business intakes in Russia’s goods-producing sector grew further in November. Additionally, the rate of growth was the quickest since January 2013, with anecdotal evidence suggesting that higher new orders partly reflected increased advertising efforts.

In contrast, new export orders fell again, albeit at the softest pace for three months. Russia’s manufacturers increased their purchasing of raw materials and semi-finished goods further in November. The extent to which input buying rose, was the sharpest in 68 months. However, preproduction inventories continued to decline at a solid pace.

"November’s solid upturn makes for a stark contrast from the beginning of the year, when firms were struggling to contend with waning demand and steeper cost inflation. Now, moving into December, the sector is on course to enjoy its strongest quarter for almost six years," said Samuel Agass, Economist, IHS Markit.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election