Samsung Electronics Co. Ltd (KS:005930) announced a stronger-than-expected profit forecast for the third quarter of 2025, fueled by surging demand for artificial intelligence (AI) technologies and a rebound in the global memory chip market. The South Korean tech giant estimated its operating profit at approximately 12.1 trillion won ($8.4 billion), surpassing market expectations of 10.1 trillion won, according to Reuters. This marks a solid increase from the 9.18 trillion won reported in the same quarter last year.

The company projected consolidated sales of 86 trillion won, up from 79.1 trillion won a year earlier, signaling a significant turnaround driven by the recovery in chip prices and growing global demand for high-performance computing solutions.

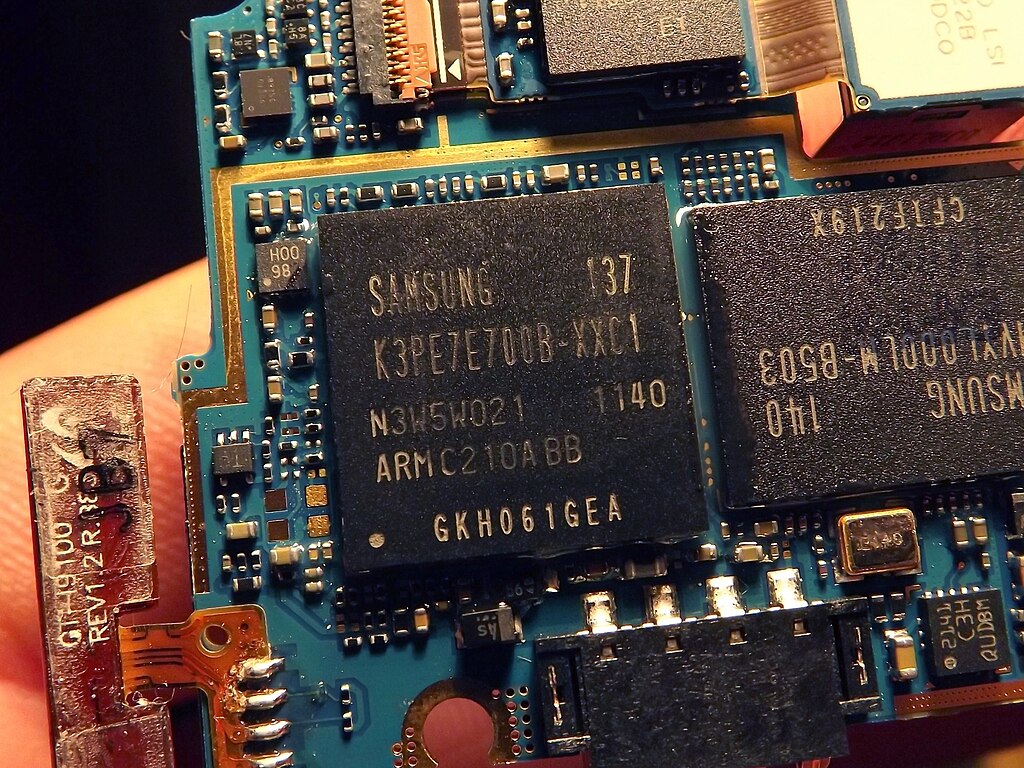

Samsung’s robust performance reflects a broad recovery in memory chip demand, particularly for AI-powered servers and high-bandwidth memory (HBM) chips. The company has benefited from the booming AI sector, as tech firms accelerate investments in advanced computing infrastructure. Demand for traditional DRAM and NAND flash memory products has also improved after a prolonged industry downturn over the past two years.

In a major strategic development, Samsung has reportedly cleared NVIDIA Corporation’s (NASDAQ: NVDA) performance requirements for HBM supply, paving the way for shipments to one of the world’s largest AI chip manufacturers. This milestone strengthens Samsung’s position in the competitive AI hardware market dominated by high-end memory solutions.

The company is expected to release its full third-quarter earnings report later in October, which will provide further insight into its performance across key business units, including semiconductors, mobile, and displays. With global AI investment continuing to surge, Samsung appears well-positioned to capitalize on the growing demand for next-generation memory technologies.

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences