Australia Bureau of Statistics data has confirmed the massive economic hit from the COVID-19 pandemic, with total hours worked across the economy officially falling 9% between early March and early April 2020.

Our analysis, using data from the quarterly ANUpoll, suggests the self-employed have been hit harder, with average weekly hours dropping by almost a third between February and April 2020. More than eight out of 10 self-employed Australians say their profits have taken a significant hit.

Decline in hours worked for the self employed

The ANUpoll is an important economic and social barometer in Australia because it is a longitudinal survey – polling the same group of people multiple times throughout the year. This enables a more accurate snapshot of how individuals are being affected.

The data we are releasing today was collected from 3,155 Australians between April 14 and April 27.

It shows the 32% drop in hours worked by the self-employed (from 35.2 to 23.8 hours) was about double that of all employees, whose hours declined by 16% (from 35.5 to 29.7 hours).

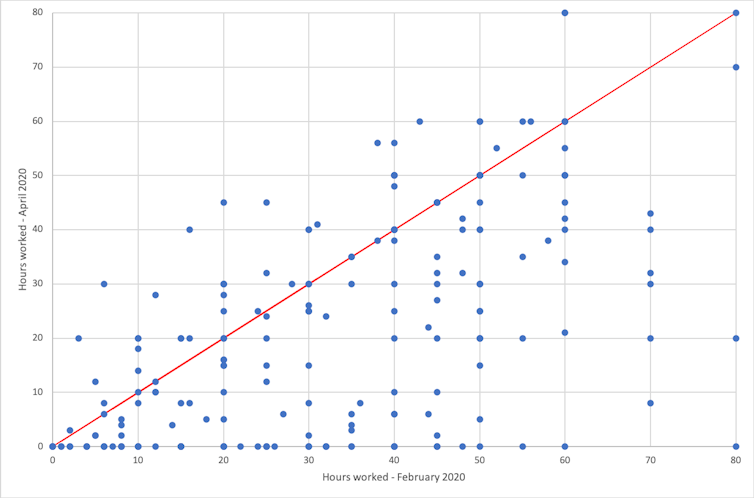

The following infographic illustrates the degree of decline for all the self-employed in the poll (about 240 people). The blue dots above the red line show those working more hours in April; those below the line show those working less. Note the number at or near zero.

Comparing weekly hours worked by the self-employed in February to April 2020. ANU Centre for Social Research and Methods, Author provided

Almost a third said their business would be unviable if financial trends continued for two months. If trends persisted for six months, 40% doubted they could survive.

The impact on savings and wellbeing

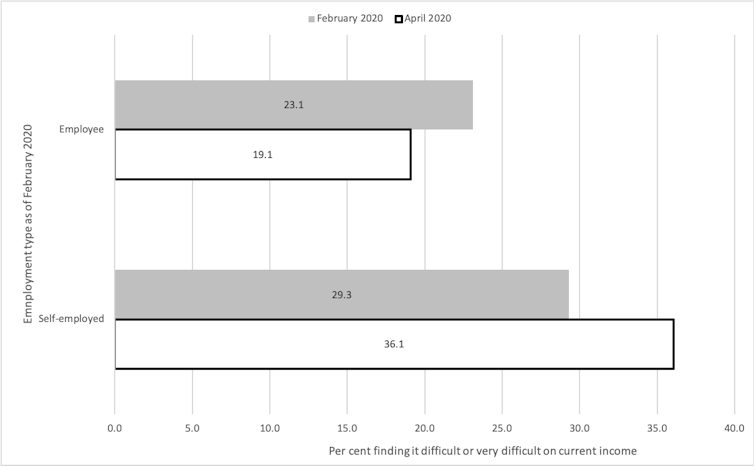

The proportion of self-employed saying they were finding it difficult or very difficult to survive on their current income increased from 29% to 36%.

Proportion of people finding it difficult or very difficult on their current income, by employment type. ANU Centre for Social Research and Methods

This contrasts with an aggregate improvement among employees, most likely due to higher payments for those on lower incomes, such as the A$750 given to social security recipients.

21% of self-employed respondents said they had accessed retirement savings or superannuation early, compared with 7% of employees.

Among those thinking their business was unviable, 69% reported feeling anxious and worried, compared with 59% of those thinking their business was viable. Life satisfaction was also lower (5.6 out 10 compared to 7.0).

What does this mean for the self-employed in 2020?

Current policies includes a large amount of targeted assistance for the self-employed. Without that assistance, the outcomes summarised above would be far worse.

As physical distancing restrictions are eased, it will be important to continue to monitor how the self-employed are faring to ensure the level of government support is sufficient and well-targeted.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock