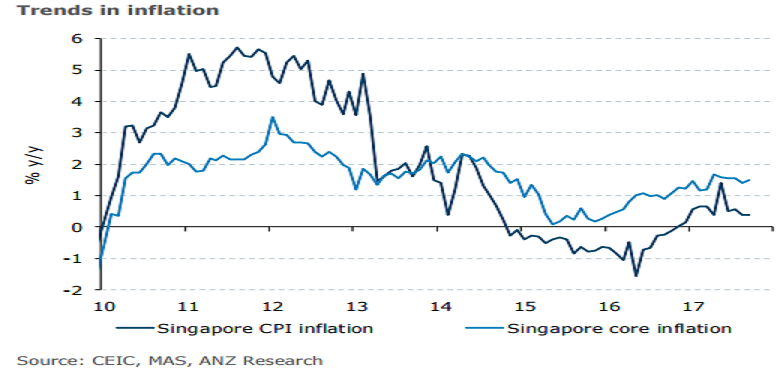

Singapore’s headline inflation stabilized at 0.4 percent in September, in line with market estimates. Core inflation edged up slightly due to an increase in services costs and telecommunications fees in particular.

As such, any near-term price pressures are not seen. Monetary policy should, therefore, remain in neutral mode. However, we will be examining the Q3 labor market data due this Friday to assess whether there has been any improvement in the employment and wage situation. Labour market conditions tend to be a good leading indicator of inflation in Singapore.

On an m/m basis, headline inflation was flat in September compared with a 0.3 percent increase in the preceding month. Private road transport costs contracted 0.3 percent m/m, reflecting both lower car prices as well as a moderation in COE premiums. Accommodation costs fell 0.3 percent m/m amid lingering softness in the home rental market.

By contrast, food prices edged up 0.2 percent m/m. Meanwhile, core inflation, which in Singapore’s case, excludes accommodation and private road transport costs, edged up slightly. However, apart from telecommunication service fees, other components remained subdued in their recent ranges.

"Consequently, inflationary pressures have been muted. The inflation data reinforces our view that there is no urgency for the Monetary Authority of Singapore (MAS) to exit from their current neutral policy stance," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal