According to talks and rumors in the market, the Czech Central Bank, which has kept the Czech Koruna (CZK) pegged with the Euro since 2013 at 27 per euro could soon break away from this monetary policy regime. In an attempt to prevent the economy to drop into a deflationary state and to protect the country’s exports to the monetary union, the central bank has maintained this peg but has been forced to buy foreign currency to compensate for the strength in Koruna. After the European Central Bank (ECB) introduced quantitative easing in 2015, the bank has been forced to buy at an unprecedented rate. Czech forex reserve has soared from just $40 billion in 2013 to $85 billion in December last year.

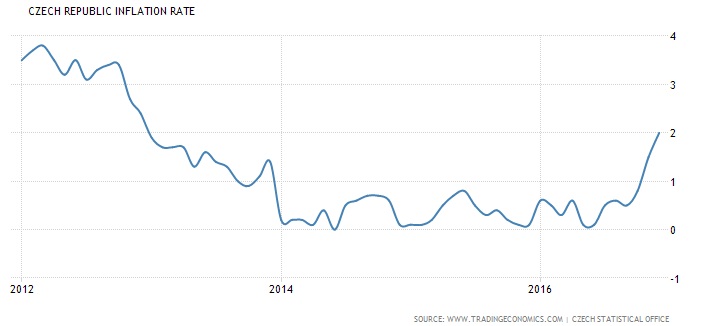

The current interest rate maintained by Czech central bank is 0.05 percent, a much higher compared to European Central bank’s -0.4 percent, already provides investors with an incentive to buy Koruna against the Euro and it would become extremely difficult to maintain the peg if the Czech central bank increases the rates further. The 2 percent inflation figure in December is calling for the central bank to increase rates or face the risk of runaway inflation leading to fast rate hikes.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated