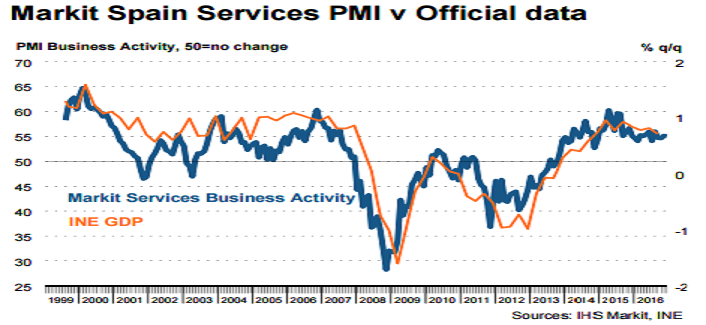

The Spanish service sector remained in growth territory at the end of 2016, with further increases in both business activity and new orders recorded in December. Higher fuel costs drove acceleration in the pace of input price inflation, while the rate at which output charges increased also quickened.

The headline seasonally adjusted Business Activity Index posted 55.0 in December, thereby signaling a further marked monthly rise in service sector activity. The reading was broadly unchanged from 55.1 in the previous month. Activity has increased continuously since November 2013, with the latest expansion attributed to increased new business amid improving client confidence and marketing activities.

New business continued to expand during December, with some panellists reporting improving market conditions. Although remaining solid, the rate of growth eased marginally from that seen in November. Growth of business activity was registered across all six monitored sectors, led by Post & Telecommunications.

The rate of input cost inflation in the service sector quickened to a 69-month high. According to respondents, higher fuel costs was the principal factor leading input prices to rise, while increases in energy and staff costs were also mentioned. The Hotels & Restaurants and Transport & Storage sectors registered the sharpest rises in input prices.

"Activity continued to rise markedly, but companies will be hoping that growth of new orders can pick up in coming months to return to the rates seen earlier in 2016. IHS Markit currently forecasts a rise in GDP of 2.1 percent in 2017," said Andrew Harker, Senior Economist, IHS, Markit.

Meanwhile, EUR/USD traded at 1.04, up 0.22 percent; at 9:00GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at -39.38 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility