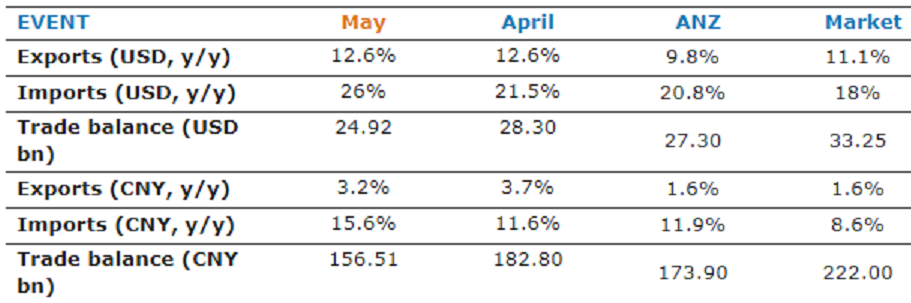

Solid momentum in China’s trade balance data is expected to provide some upside to Q2 GDP growth. Trade data, including export growth, beat consensus in April and May, showing few signs that the trade sector has been much affected by the on-going China-US trade tension. This may provide upside surprise to Q2 GDP growth, which is due on July 16.

Strong import momentum continued in May, led by high-tech products. High-tech product imports continued growing in double-digits for three consecutive months, contributing 7.3ppt to overall import growth in May. Imports of electronic integrated circuits grew 36 percent y/y in May, taking monthly average growth for the first five months to 37.6 percent y/y.

Major commodity imports have continued recovering on the back of steady domestic activities, with coal and iron ore imports rising 0.6 percent y/y and 2.9 percent y/y. The trend is expected to continue in the coming months on the back of recovering manufacturing activities.

Exports grew in double-digits, supported by mechanical and electronic (ME) exports. ME exports – which account for about 60 percent of China’s total exports – increased 14.8 percent y/y in May, contributing 8.3ppt to overall export growth. High-tech product exports also grew steadily by 17.7 percent y/y in May, the seventh month of double-digit growth since November 2017.

"We remain alert to the risks surrounding China-US trade negotiations, which re-emerged after President Trump recently said that USD50bn worth of Chinese products are still subject to 25 percent import tariffs, with the product list to be unveiled on June 15," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election