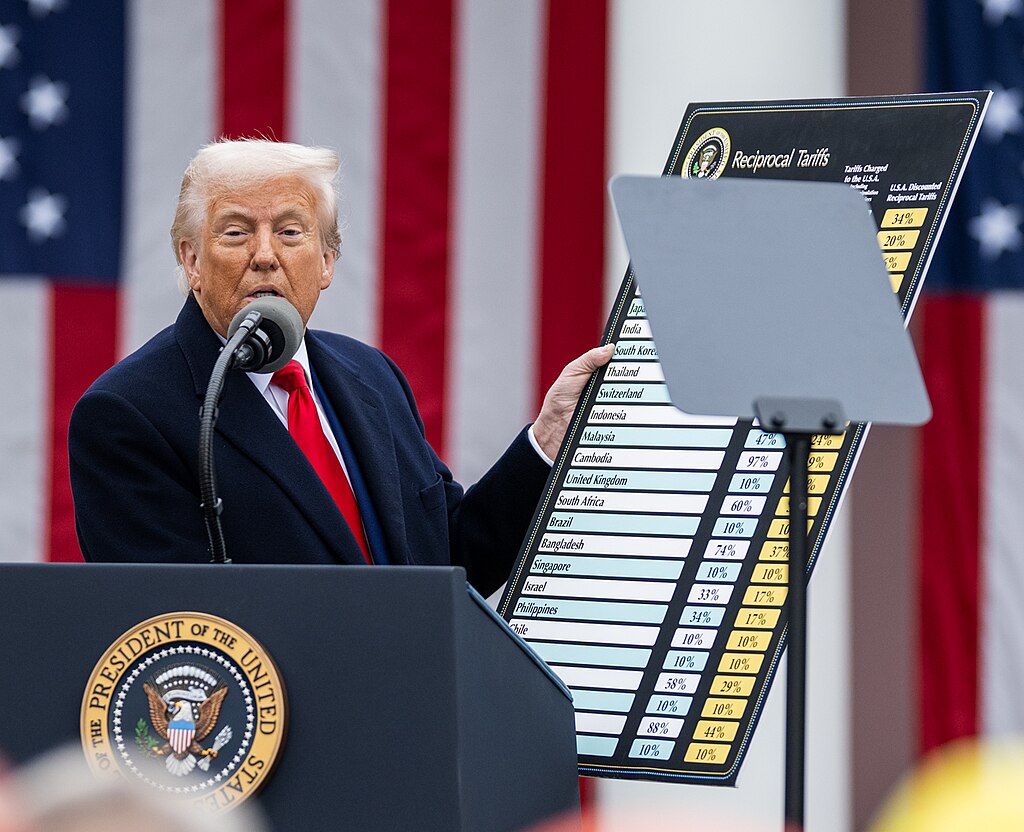

The U.S. dollar’s dominance faces renewed scrutiny as the Supreme Court prepares to examine whether President Donald Trump’s use of emergency powers under the International Emergency Economic Powers Act (IEEPA) to impose tariffs was lawful. According to Macquarie economists, the ruling could have far-reaching implications for inflation, Federal Reserve policy, and the broader U.S. economy.

Macquarie noted that removing some or all IEEPA tariffs could revive disinflation trends, easing inflation expectations and allowing the Federal Reserve to pivot toward more rate cuts. The bank’s analysts estimated that without the new tariffs, consumer inflation in September would have been around 2.2%, compared to the reported 2.9%. A decision against the tariffs could weaken the U.S. dollar while initially pushing long-term Treasury yields higher.

At the core of the legal challenge is whether Trump’s reliance on the IEEPA grants him the authority to impose tariffs. Opponents argue that trade deficits do not constitute national emergencies, while Trump’s legal team insists that the president alone can declare emergencies tied to national security and foreign policy.

However, Macquarie warns that Trump’s own statements could undermine his defense. His decision to hike tariffs on Brazilian exports earlier this year, citing the “witch-hunt” against former President Jair Bolsonaro, might be used as evidence that the measures were politically driven rather than economic necessities.

If deemed illegal, the loss of tariff revenue—estimated at up to $2 trillion over the next decade—could widen the U.S. fiscal deficit by 2–3% of GDP. Still, analysts say the Court might strike a balance by limiting presidential emergency powers without entirely revoking tariff authority. The final ruling, expected between late November and early 2026, could significantly influence the dollar’s trajectory and future monetary policy.

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Newly Released DOJ Epstein Files Expose High-Profile Connections Across Politics and Business

Newly Released DOJ Epstein Files Expose High-Profile Connections Across Politics and Business  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Meta Faces Lawsuit Over Alleged Approval of AI Chatbots Allowing Sexual Interactions With Minors

Meta Faces Lawsuit Over Alleged Approval of AI Chatbots Allowing Sexual Interactions With Minors  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case

US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination