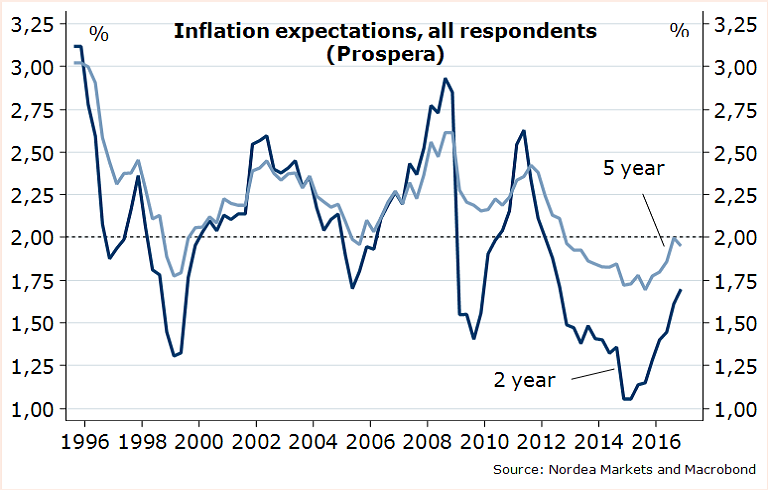

According to Prospera’s quarterly survey, the Riksbank's much watched Sweden inflation expectations for the five-year horizon came in at 1.95 percent in December, down from the 2.00 percent in September. Inflation expectations on the 1-year horizon as well as for the 2-year horizon continued to rise somewhat.

The rise in inflation expectations during the past year coincides with the uptick seen in CPI-inflation. Data released by Statistics Sweden on Tuesday showed that Sweden's consumer price inflation accelerated for the second straight month in November to the highest level in more than four-and-a-half years. Swedish consumer price index rose 1.4 percent year-over-year in November. Underlying inflation rate was up 1.6 percent year-over-year, up from 1.4 percent a month ago.

"The bank will see this as a sign that monetary policy works and that the credibility for the inflation target has strengthened. Today’s figures, therefore, decrease the likelihood for our forecast that the Riksbank will cut its policy rate by 10 bps," said Nordea Bank in a report.

Survey showed wage expectations from representatives of both the employers’ and employees’ organisations edged down and are now below the historical averages. The modest wage expectations suggest that the already low wage growth will not rise, despite the strong labour market. Such an environment makes it challenging for the Riksbank to raise inflation and keep up inflation expectations.

Swedish Central Bank Deputy Governor Martin Floden at a conference last week said the current upward trend in Sweden's inflation expectations was "reassuring" and that a low-interest rate environment, while associated with some risks, was unavoidable in order to drive price increases ahead.

EUR/SEK was trading at 9.7426, while USD/SEK was trading at 9.1474 at 1215 GMT. Markets await FOMC monetary policy decision due later in the U.S. session. FxWirePro's Hourly EUR Spot Index was at -134.711 (Highly bearish) at 1215 GMT, USD Spot Index was at 64.2027 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Sweden 1-2 year inflation expectations continue to rise, reduce likelihood of Riksbank rate cut

Wednesday, December 14, 2016 12:21 PM UTC

Editor's Picks

- Market Data

Most Popular

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks