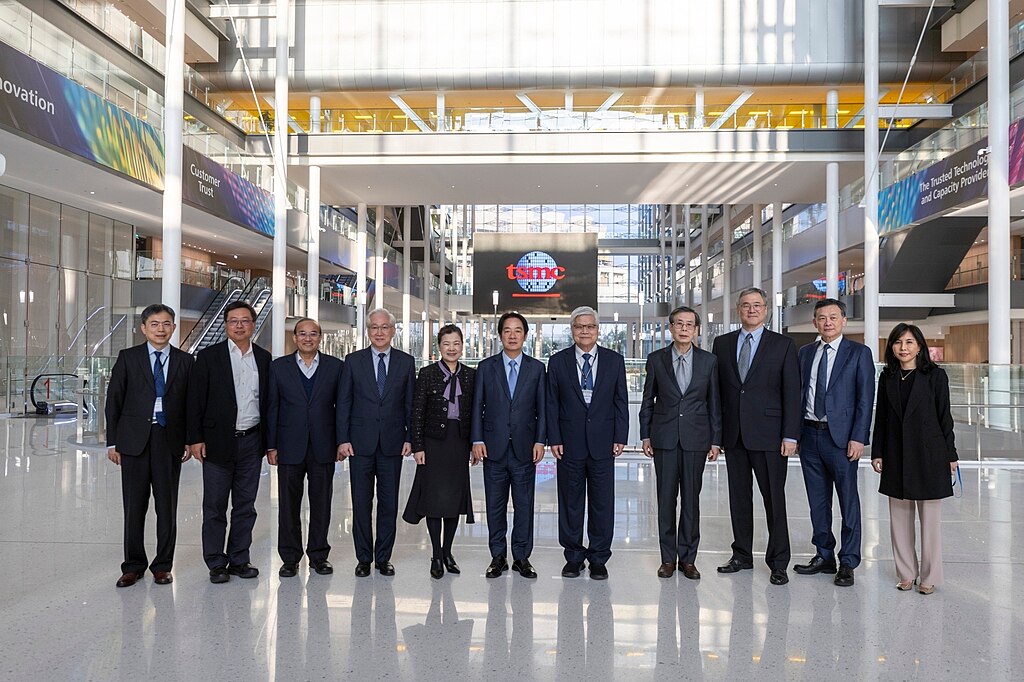

TSMC Stock Soars on Record Earnings, AI Demand

TSMC's share price reached an all-time high on Friday after the leading contract chipmaker reported stronger-than-expected third-quarter earnings and provided a positive outlook driven by robust Artificial Intelligence (AI) demand.

Key Takeaways:

-

TSMC's stock price surged 6% to T$1,100 ($34.25) at the market open, surpassing the previous record set in July 2023.

-

The company boasts the highest market capitalization in Asia at around $884 billion.

-

TSMC benefits from the booming AI sector, counting Apple and Nvidia among its major clients.

-

The chipmaker expects continued growth over the next five years.

Addressing U.S. Probe

Following a media report suggesting a U.S. investigation into TSMC's dealings with Huawei, the company reaffirmed its commitment to legal compliance, including export control regulations.

TSMC remains a reliable partner, stating:

"If we have any reason to believe there are potential issues, we will take prompt action to ensure compliance, including conducting investigations and proactively communicating with relevant parties, including customers and regulatory authorities as necessary."

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient

Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient  Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  Wall Street Futures Tumble as U.S.-Iran Conflict Escalates and Oil Prices Surge

Wall Street Futures Tumble as U.S.-Iran Conflict Escalates and Oil Prices Surge  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens

Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens  Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran

Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement  Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge

Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge  Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand

Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand  ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny

ASX CEO Exit Signals Turbulent Transition Amid Lawsuit and Regulatory Scrutiny  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes

Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes  Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure