Electric vehicles and Self-driving cars is one of the biggest disruptions in the global economic landscape right now. EVs have the potential to shift the balance of power from crude oil to other sustainable sources of energy. Now, traditional automakers are working on building EVs and hybrids because EVs are here to stay. Self driving cars are also setting up shop to be a huge part of the future because self-driving cars will be more aware, make better driving decisions, and reduce instances of auto accidents.

As the development of self-driving cars continue to progress, many experts have predicted an end of the era of the auto insurance industry. In May, the legendary investor, Warren Buffet expressed fears that self-driving cars could hurt Berkshire Hathaway's auto insurance business. In his words, “If they (self-driving cars) make the world safer, it’s going to be a very good thing… but it won’t be a good thing for auto insurers.” This piece however provides insights into why such fears might be overblown.

The auto insurance is set to see a new burst of growth

When people start looking for auto insurance, they want a financial product that limits their liabilities in the event of an accident, destruction, or loss of their vehicles. Hence, even though self-driving cars might reduce the need for insurance against accidents; self-driving cars won't necessarily be immune from storm, hail, and flood damage. Self-driving cars might also be immune from outright theft – very people will be foolhardy or daring enough to steal a car that can be tracked by GPS in real time. Yet, self-driving cars would still be targets for a criminal who is intent on stealing wheels, CDs, and GPS systems among others.

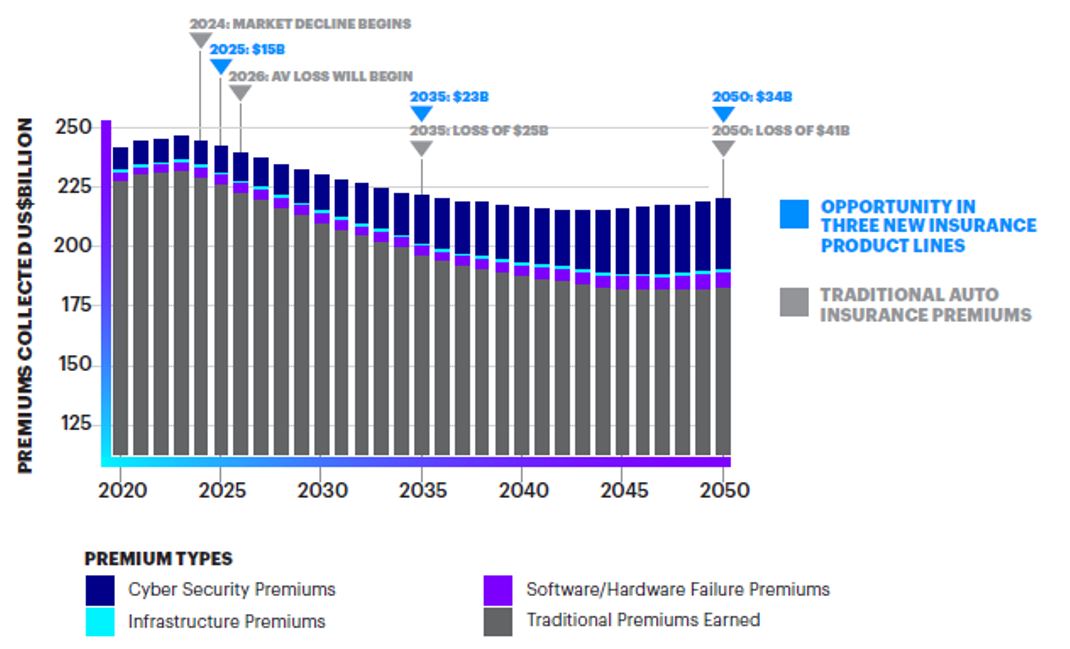

A new market research report from Accenture submits that the global auto insurance industry is on track to record massive growth in the future. In fact, the analysts at Accenture submit that the global auto insurance industry can book new insurance revenue of about $81 billion between 2020 and 2025. In the words of Accenture, "the threat posed to insurers by the rapid evolution of autonomous vehicles is real, but so is the $81 billion opportunity represented by new forms of insurance."

Self-driving cars have the potential to open up new classes of insurance products for the adaptive and proactive insurance firms as seen in the chart above. For instance, there will be need for insurance related to the cybersecurity risk of the AI infrastructure behind self-driving cars. Insurance firms will be able to offer insurance against "ransomware" that might render vehicles inoperable, hacking, and authorized access into the vehicle or its database.

Going forward, auto insurers can also provide policies that insure against hardware and software failure. Bugs, algorithm errors, memory overflow are some software weak points that could affect the smooth operation of self-driving cars. Errors in radar or LIDAR systems, faults in camera vision, and sensory circuit failures are some hardware weak points that could also trigger errors in the operation of self-driving cars.

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate