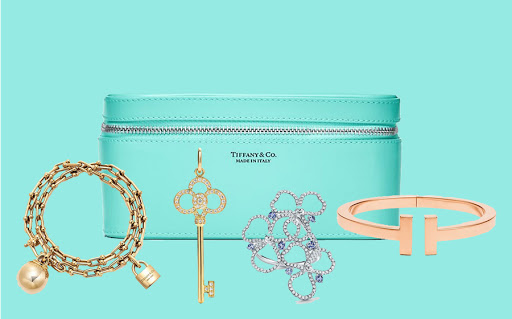

US jewelry chain Tiffany exercised the option to extend the completion of its $16.2 billion tie-up with French luxury goods giant LVMH apply on Nov. 24.

The deal wasn't closed on the Aug. 24 date set out in the documents.

Last year, Louis Vuitton owner LVMH agreed to buy Tiffany, hoping to restore the US jeweler's luster via new collections and spruced-up stores.

Tiffany and LVMH set Aug. 24 as the first deadline, but with a proviso that either party could push it as far as Nov. 24.

The LVMH and Tiffany deal has yet to receive regulatory approvals, particularly from the European Union.

LVMH earlier deliberated about renegotiating the deal, partly due to the impact of the COVID-19 epidemic on Tiffany.

But LVMH decided against a re-negotiation.

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns