Toss Pay has joined hands with CU convenience store chain to expand its service and include offline transactions. CU is owned and operated by BGF Retail, and the mobile payment firm tapped it for partnership as it makes another move to accelerate its business by adding new offerings.

Toss Pay’s expansion to accommodate offline transactions will also make the company more competitive against its rivals in the local payment scene. According to The Korea Times, through the deal, the mobile payment firm has become available at about 17,000 convenience store outlets owned by CU across the country.

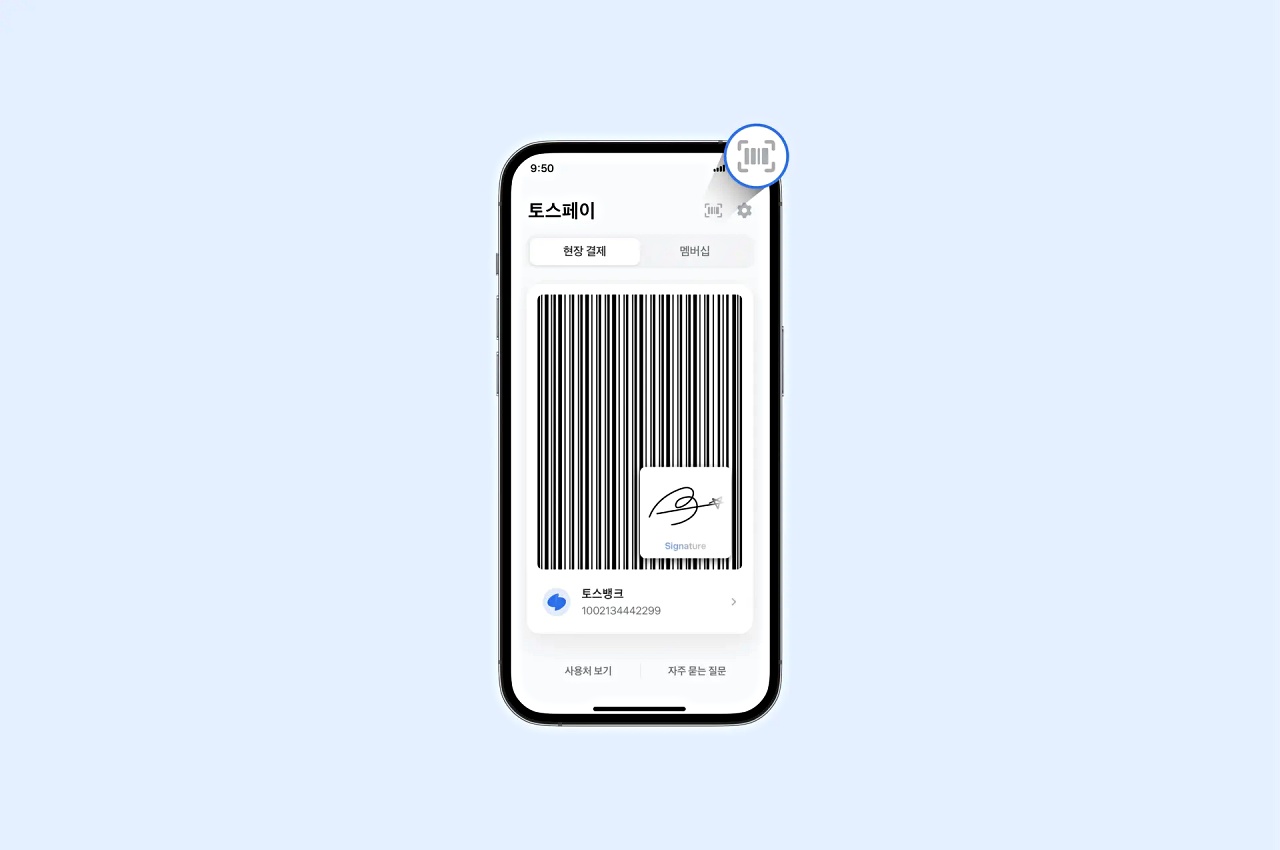

The Toss Pay payment service at CU convenience stores was officially launched on Monday, July 10. At the stores, customers will be able to pay by using a barcode scanning system on their Toss app. The payment will then be charged to the customers’ credit cards or deposit accounts linked to their app.

Users can use Toss Pay in CU convenience stores for a variety of transactions, such as phone bills payment, shopping, and even tax payments. The South Korean fintech company said that its collaboration with the store chain is expected to grow further in the second half of this year so that the payment system could be used for wider purposes.

"By using Toss Pay, customers can automatically earn CU membership points, while making the payments simply and swiftly," a Toss Pay official said in a statement. "Toss Pay will be extended to be used at more offline stores, including franchise coffee shops and gas stations, hoping to become the most frequently used payment tool in everyday life."

Finally, in a press release, Toss said the deal will improve the versatility of its Tospay and starting this month, it is now possible to pay at CU via the Toss app without the need to carry a separate wallet.

Photo by: Toss Press Release

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised