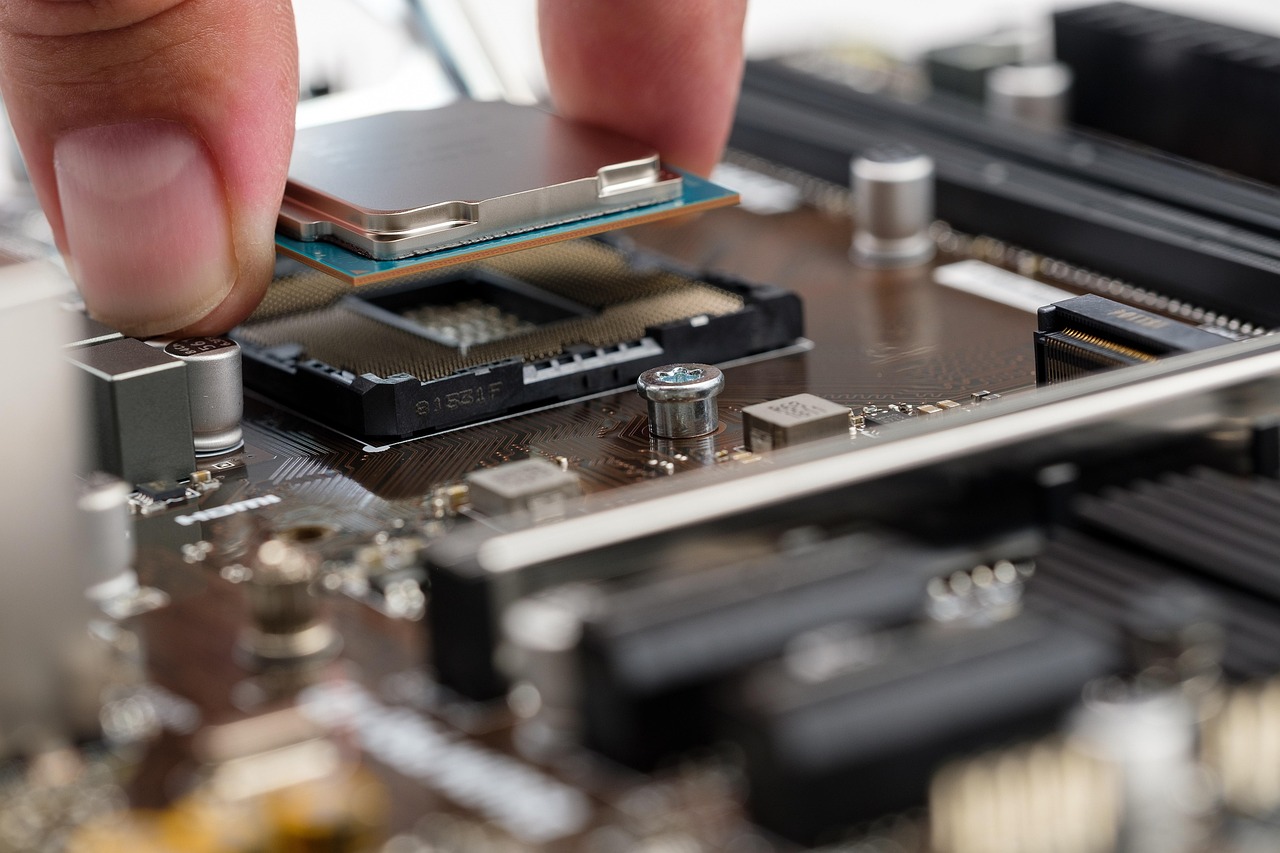

U.S. chip stocks dropped Monday following reports that the Trump administration is planning stricter controls on China’s tech sector. The proposed rule would expand current sanctions to include subsidiaries of blacklisted companies, closing a loophole that has allowed Chinese firms to bypass restrictions by creating new corporate entities.

According to Bloomberg, the rule would require U.S. government licenses for transactions involving any firm that is at least 50% owned by a company already on the U.S. Entity List, Military End-User list, or the Specially Designated Nationals list. The regulation, still under discussion, could be introduced as early as June and may pave the way for further sanctions against Chinese tech giants.

The move comes amid rising U.S.-China tensions, especially in the semiconductor sector. On Friday, President Donald Trump accused Beijing of undermining recent Geneva trade negotiations. In response, China expressed frustration over U.S. chip export controls, while the U.S. criticized China’s restrictions on critical minerals.

Markets reacted swiftly. Nvidia (NASDAQ: NVDA) fell 1%, Marvell Technology (NASDAQ: MRVL) dropped 1.9%, and Broadcom (NASDAQ: AVGO) declined 0.9%. Taiwan Semiconductor Manufacturing Co. (TSMC) slipped 0.9%, and the iShares Semiconductor ETF (NASDAQ: SOXX) was down nearly 1% in premarket trading. Chinese chipmakers were also hit, with SMIC down 1.1% and Hua Hong Semiconductor losing nearly 3% in Hong Kong.

This policy shift underscores Washington’s intent to curb China’s tech rise by targeting not only parent companies but also their global subsidiaries. U.S. officials have described the regulatory gap as a game of “whack-a-mole,” emphasizing the need for tighter enforcement to prevent circumvention of existing sanctions.

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations

Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Administration Expands Global Gag Rule, Restricting U.S. Foreign Aid to Diversity and Gender Programs

Trump Administration Expands Global Gag Rule, Restricting U.S. Foreign Aid to Diversity and Gender Programs  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  RFK Jr. Overhauls Federal Autism Panel, Sparking Medical Community Backlash

RFK Jr. Overhauls Federal Autism Panel, Sparking Medical Community Backlash  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges