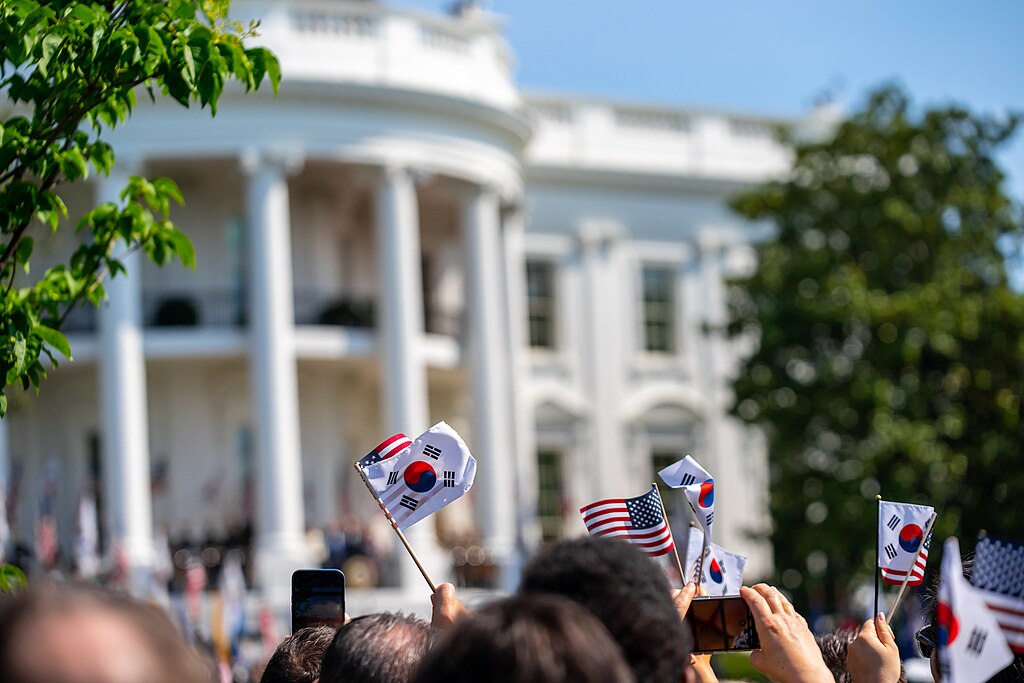

President Donald Trump announced a new trade agreement with South Korea, reducing tariffs on key imports to 15% and securing a $350 billion investment pledge from Seoul. The deal, revealed after meetings at the White House, eases tensions with one of America’s top trading partners and key Asian allies.

Under the agreement, South Korea will invest $350 billion in U.S. projects chosen by Trump and purchase $100 billion worth of American liquefied natural gas and other energy products. Both countries also plan to establish a $350 billion investment fund, with $150 billion earmarked for shipbuilding cooperation.

The new terms replace a previous 25% tariff on South Korean goods such as automobiles, steel, and semiconductors. Trump confirmed that South Korea will allow more U.S. products, including cars, trucks, and agricultural goods, without imposing duties. Meanwhile, tariffs on South Korean chip and pharmaceutical exports will remain competitive with other countries, while rice and beef markets stay protected.

South Korean President Lee Jae Myung hailed the agreement as positioning his country on par or better than other trade partners. Details of the investment structure and implementation timeline remain unclear.

The announcement comes as South Korea’s Samsung Electronics signed a $16.5 billion semiconductor deal with Tesla, while LG Energy Solution secured a $4.3 billion battery supply agreement for Tesla’s energy storage systems.

Lee is expected to visit the White House within two weeks for further discussions, signaling deeper economic and strategic cooperation between the U.S. and South Korea amid evolving global trade dynamics.

This deal follows similar tariff reductions recently reached with Japan, highlighting the U.S. administration’s broader efforts to renegotiate trade terms with major Asian economies.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock