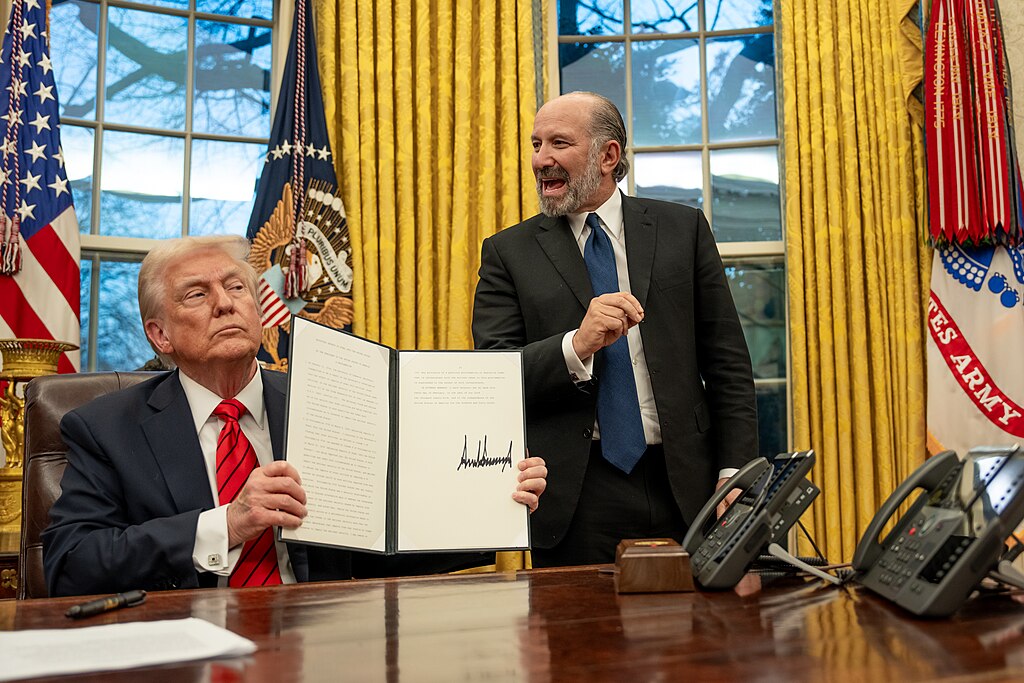

U.S. President Donald Trump aims to eliminate taxes for individuals earning less than $150,000 annually, according to Commerce Secretary Howard Lutnick in a recent CBS News interview.

“I know what his goal is—no tax for anybody making under $150,000 a year. That’s what I’m working for,” Lutnick stated, emphasizing Trump’s broader tax reform efforts. He also highlighted plans to remove taxes on tips, overtime, and Social Security, aligning with Trump’s push for substantial tax cuts for both individuals and corporations.

Concerns over rising national debt due to tax cuts were met with Lutnick’s assurance that increased revenue would come from tackling overseas tax fraud. He claimed that curbing tax evasion could help fund Trump’s ambitious tax policies without burdening American taxpayers. Additionally, he pointed to Trump’s proposed $5 million U.S. visa program as a way to boost fiscal revenue.

Trump’s $4.5 trillion tax cut plan was approved by the Republican-led House of Representatives in February and now faces a Senate vote. While his administration seeks to slash government spending to reduce the deficit, policies enforced by the Department of Government Efficiency—particularly mass layoffs of federal employees—have sparked controversy.

Economic concerns under Trump’s leadership have intensified, especially amid fears of a recession fueled by his aggressive tariff policies. When asked about potential economic risks, Lutnick stated that pushing Trump’s policies would be “worth it,” even if it meant facing a recession.

As debates continue, Trump’s tax strategy remains a central topic, shaping discussions on government revenue, job markets, and economic stability ahead of the upcoming elections.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Illinois Joins WHO Global Outbreak Network After U.S. Exit, Following California’s Lead

Illinois Joins WHO Global Outbreak Network After U.S. Exit, Following California’s Lead  Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement

Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement  Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute

Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Pentagon and Anthropic Clash Over AI Safeguards in National Security Use

Pentagon and Anthropic Clash Over AI Safeguards in National Security Use  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster