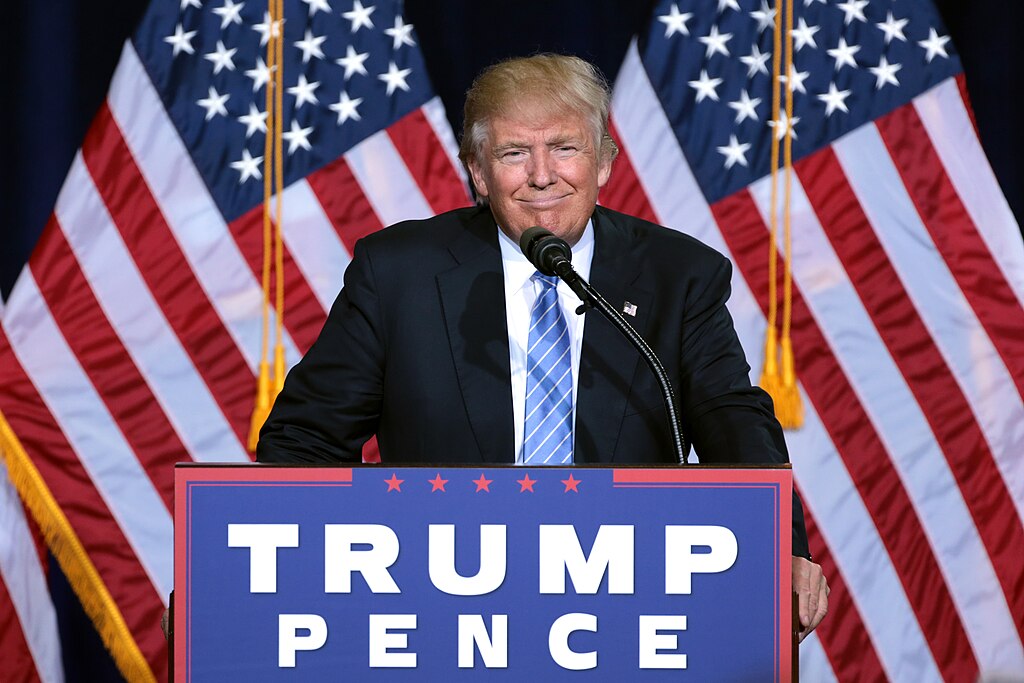

The Democratic-led Senate and Republican-controlled House of Representatives have reconvened for a crucial three-week session, facing high-stakes negotiations over government funding and disaster relief. These debates are unfolding just weeks before President-elect Donald Trump assumes office, bringing with him promises of fiscal and legislative reform.

At the heart of the discussions is a looming Dec. 20 deadline to avert a partial government shutdown. Lawmakers are weighing options that range from a long-term omnibus spending bill to a shorter stopgap measure. The latter, backed by Trump allies, would allow the incoming administration greater control over fiscal year 2025 appropriations.

Adding to the complexity, the Biden administration has requested nearly $100 billion in emergency disaster relief for hurricane-ravaged communities and other areas hit by natural disasters. Meanwhile, the clock is ticking on a Jan. 1 deadline to raise the federal debt ceiling, though Treasury Department measures may delay immediate action.

Spending Bill Dilemmas and Political Maneuvering

Push for Omnibus vs. Stopgap Measures

Senate Democrats, entering their final days in the majority, advocate for an omnibus spending bill to fund the government through September 2025. Senator Susan Collins, the top Republican on the Senate Appropriations Committee, expressed optimism about avoiding a continuing resolution, or CR. However, House Speaker Mike Johnson and conservative lawmakers favor a short-term measure to retain leverage for Trump’s agenda.

Representative Chip Roy, a leading conservative voice, tweeted last week: “We’ve made omnibus spending bills painful to vote for … now we must kill the practice.”

Disaster Relief and Defense Policy Take Center Stage

Congress must also address pressing needs like disaster relief. The Small Business Administration reported running out of funds for disaster loans in October, leaving over 60,000 applicants without assistance. Senate Appropriations Chair Patty Murray emphasized the urgency, stating, “Every day we don’t act, the costs grow.”

Additionally, lawmakers are expected to prioritize the National Defense Authorization Act (NDAA), which sets policies for the Defense Department. Aides suggest floor votes could begin as early as next week.

Social Media Reacts to Congressional Budget Stalemates

The budget impasse has drawn widespread attention online, with mixed opinions on Congress’s ability to act decisively:

- @PolicyWatcher: “Congress has three weeks to prevent chaos. Let’s see if they can actually deliver.”

- @DisasterReliefNow: “People are suffering. Stop the political games and fund disaster relief immediately. #NoMoreDelays”

- @FiscalHawk: “Stopgap measures just kick the can down the road. We need real solutions, not short-term fixes.”

- @TrumpSupporter2024: “Trump’s team is right—hold off until January. Why let Democrats control the agenda?”

- @DefenseMatters: “Pass the NDAA first. National security shouldn’t be a bargaining chip in budget talks.”

- @CitizenConcerned: “Both parties need to compromise. Gridlock only hurts Americans waiting for aid and clarity.”

Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears

Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears  Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand

Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure  Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran

Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran  Nvidia to Launch New AI Inference Processor to Boost OpenAI Performance

Nvidia to Launch New AI Inference Processor to Boost OpenAI Performance  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street

U.S. Stocks Close Lower as Hot PPI Data, Nvidia Slide Weigh on Wall Street  Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient

Australian Job Advertisements Hit 16-Month High as Labour Market Stays Resilient  OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO

OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets