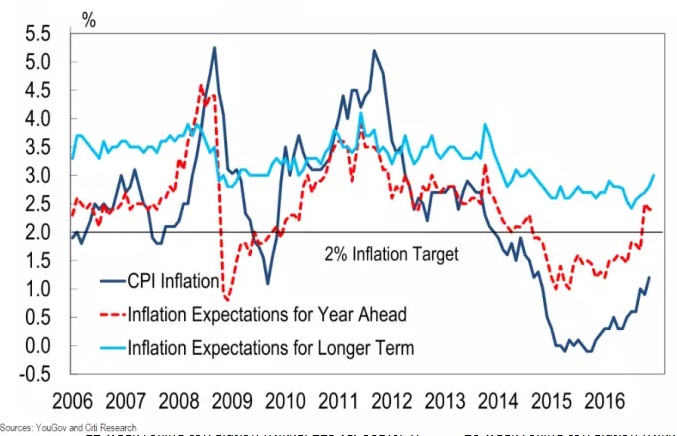

According to a Citi/YouGov poll, the long-term inflation expectation, which is for 10 years has reached 3 percent, the highest level since September 2014. It is up from 2.8 percent level seen in the previous survey. It also marks the fifth consecutive monthly increase in the wake of the referendum in June, in which the majority of the Britons voted in favor of moving out of the European Union.

However, the 3 percent number is still below the all-time high of 4.1 percent seen in 2011 and the long-term average of 3.3 percent. The alarming isn’t the level but the pace of the rise in expectations. Within a matter of months, the inflation expectation is up by more than 20 percent. One of the biggest reasons behind the move has been the decline in the Pound which has dropped. It has declined more than 18 percent since the referendum, leading to an increase in the cost of imports.

The same survey also reports that British consumers’ expect price rise of 2.43 percent over the next 12 months, whereas the Bank of England (BoE) has forecasted a rise of 2.7 percent. This fast rise has also prompted the central bank to indicated that the probability of rate hike is equal to that of a cut.

China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility