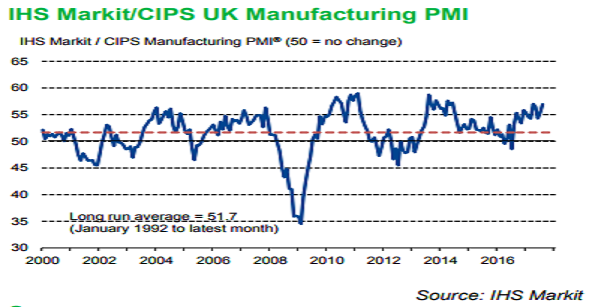

The United Kingdom’s manufacturing Purchasing Managers’ Index (PMI) for the month of August hit a 4-month high as all five of the PMI components – output, new orders, employment, suppliers’ delivery times and stocks of purchases, were consistent with a stronger performance for the manufacturing industry during August.

The rate of expansion in the UK manufacturing sector accelerated again in August. This was highlighted by the seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index (PMI) posting 56.9, up from 55.3 in July, to its second-highest level in over three years.

The domestic market was the prime source of new contract wins, while the trend in new export business also remained robust. Although the rate of improvement in foreign demand eased from July’s near-record high, it remained among the strongest seen since new export orders data were first collected in January 1996.

The stronger performance of the manufacturing sector filtered through to the labor market in August. Job creation was recorded for the 13th straight month, with the rate of increase the quickest since June 2014. Purchase price inflation accelerated for the first time in seven months during August. However, the overall rate of increase remained well below the record high seen at the start of the year.

"The survey data suggest that the manufacturing economy remains in good health despite Brexit uncertainty, and should help support on-going growth in the economy in the third quarter, which will add fuel to hawkish policymakers’ calls for higher interest rates," said Rob Dobson, Director, IHS Markit.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure