UK ILO labour market figures for the 3 months to March released today showed that UK's unemployment rate resumed its move lower, dipping to 4.6 percent, a new post-crisis low. Data was better than market expectations which called for an unchanged reading at 4.7 percent. The unemployment rate which was near the lows seen since the 1970s suggests a very tight labour market.

However, data showed that earnings growth remains muted. Data from the Office for National Statistics showed regular pay rising just 2.1 percent in the three months to March. That was the smallest gain since July of last year. Overall average weekly pay (including bonuses) posted a 2.4 percent annual growth pace, only marginally up from 2.3 percent last month. Weakening wage trend amidst rising inflation which has spiked higher to 2.7 percent, suggests a squeeze on real pay growth is likely to continue.

“Further signs of sluggish wage growth add to fears that economic growth will slow in coming months amid weaker consumer spending," said Chris Williamson, Chief Business Economist, IHS Markit.

UK employment picked up further and posted a much larger-than-expected increase over the quarter. The jobless rate fell from 4.7 percent to 4.6 percent, the lowest since 1975. Over the same period, employment rose by a solid 122,000 to almost 32 million, the highest since records began in 1971, confirming PMI data which also showed robust hiring being sustained into the second quarter. Participation rate held at 63.6 percent in the 3-month reporting window to March, while average hours worked picked up to 32.2 from 32.1 previously. Overall, the data suggest that any remaining slack continues to be absorbed.

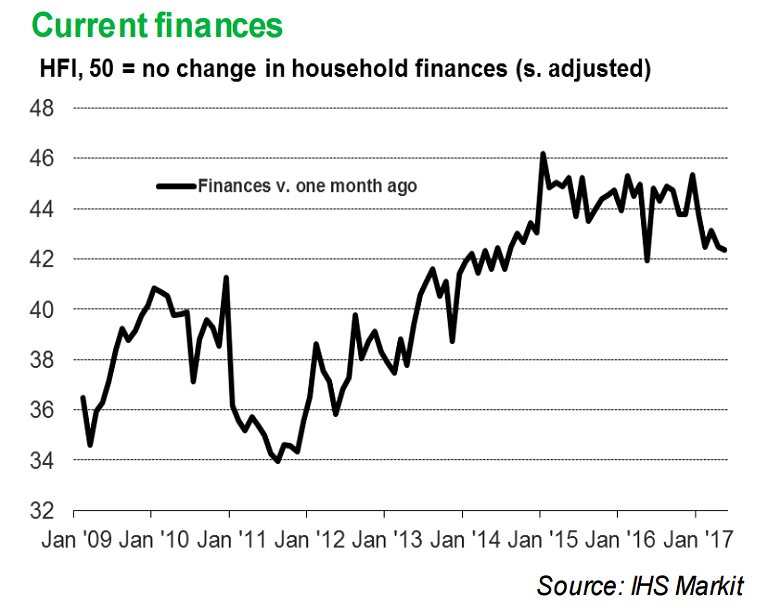

The Household Finance Index, also published today, showed UK household finances remain under greatest pressure since mid-2014. Sharp deterioration in UK household finances continued during May and households reported one of the fastest rises in living costs since early-2014. The impact of falling real pay was likely already evident on family budgets. Data showed a steep decline in the amount of cash that families have available to spend. A drop in cash available for households to spend is likely to limit retail sales growth.

"In the absence of a further slowdown in economic growth, a more rapid pace of wage growth over the course of 2017 would raise concerns for some Bank of England policymakers that higher inflation is becoming embedded in expectations, warranting a tighter policy stance. However, the relatively muted message on pay trends in today’s data – especially when considering pay per hour – continues to argue against this course of events," said Lloyds Bank in a report.

GBP/USD was 0.38 percent higher on the day at 1.2966 at around 1115 GMT. The pair finds major resistance around 1.3000 and any break above confirms bullish continuation. Any break above will take the pair till 1.3050/1.3088 in the short term. Short term trend is bullish as long as support 1.2830 holds. FxWirePro's Hourly GBP Spot Index was at 77.0944 (Slightly bullish) at 1115 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom