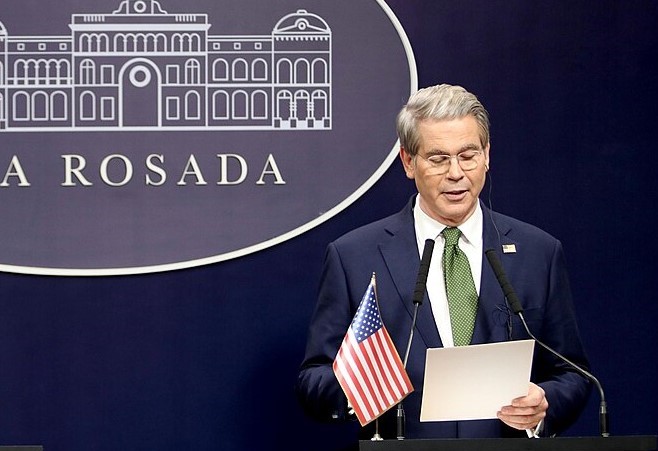

U.S. Treasury Secretary Scott Bessent announced an extension of extraordinary cash management measures to avoid breaching the federal debt ceiling, pushing the deadline to July 24. In a letter to congressional leaders, Bessent said the ongoing “debt issuance suspension period,” previously set to expire Friday, will be prolonged. This move allows the Treasury to temporarily halt investments in certain federal pension and retiree healthcare funds, helping preserve cash to meet immediate obligations.

Bessent has repeatedly warned that without congressional action to raise or suspend the debt limit, the U.S. could run out of funds to pay its bills sometime between mid-to-late summer. Though no specific update was provided, he noted that the estimated “X-date” could shift depending on court rulings related to President Donald Trump’s tariffs, which brought in a record $23 billion in customs revenue in May.

The Treasury’s extension appears to be a strategic move to pressure lawmakers to address the debt ceiling as part of a sweeping tax-and-spending package before Congress begins its August recess. Failure to act, Bessent emphasized, could jeopardize the U.S. government's ability to meet its financial obligations.

“Based on our current estimates, we continue to believe that Congress must act to increase or suspend the debt ceiling as soon as possible before its scheduled August recess to protect the full faith and credit of the United States,” he said.

The debt ceiling standoff adds fresh urgency to Washington’s fiscal agenda as the nation inches closer to default. Investors and economists are watching closely, as political gridlock over the issue could trigger financial instability and impact global markets.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions

NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions  Marco Rubio Steps Down as Acting U.S. Archivist Amid Federal Law Limits

Marco Rubio Steps Down as Acting U.S. Archivist Amid Federal Law Limits  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  Ukraine-Russia Talks Yield Major POW Swap as U.S. Pushes for Path to Peace

Ukraine-Russia Talks Yield Major POW Swap as U.S. Pushes for Path to Peace  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Pentagon and Anthropic Clash Over AI Safeguards in National Security Use

Pentagon and Anthropic Clash Over AI Safeguards in National Security Use  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions