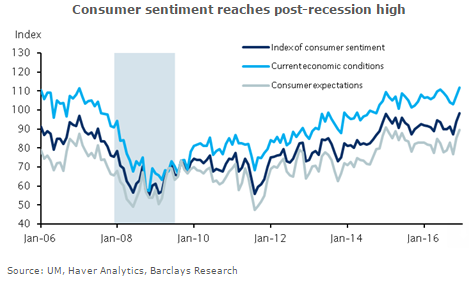

Consumer sentiment in the United States reached post-recession high during the month of December, post the victory of U.S. President-elect Donald Trump and expectations of a protectionist policy by him.

The University of Michigan index of consumer sentiment was revised slightly higher in the final December estimate to 98.2, from 98.0 and reached a post-recession high. The current conditions index was revised slightly lower to 111.9 (previous: 112.1), while the expectations index was revised higher to 89.5 (88.9).

Both short- and longer-term inflation expectations were revised lower, to 2.2 and 2.3 percent, from 2.3 and 2.5 percent respectively. Inflation expectations in this survey remain soft and the latest decline brings the longer-run measure to its historical low.

"Ongoing solid readings on consumer confidence reinforce our view that GDP growth should remain firm in the near term, and we see the level of confidence as consistent with ongoing strength in consumer spending," Barclays Research said in its latest research note.

Meanwhile, the dollar index traded at 102.87, down -0.14 percent, while at 6:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -14.80 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal