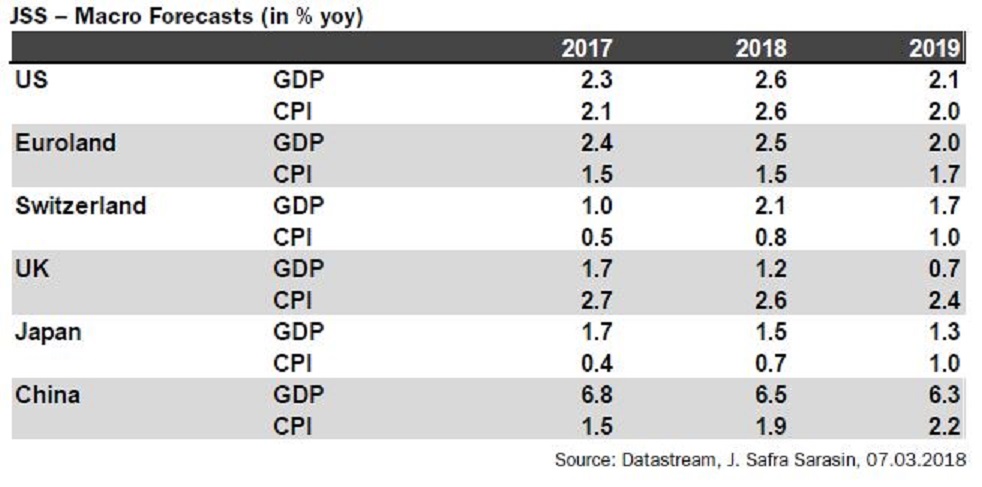

Growth remains very strong in all regions and recession risks are low even though the US-fiscal policy increases the medium-term risks of a boom-bust cycle. Main forecast revisions are that we now expect four Fed hikes in 2018, one Bank of England rate hike in May and even stronger growth rates in the eurozone and Switzerland this year. Market focus will shift to inflation developments where we are likely to have seen the trough for this year in February.

In the US, growth maintains momentum, as shown by the latest surveys of activity. Hard data suffered a partial setback at the beginning of the year, as revealed by some softness in new orders for durable goods and factory orders. Some more headwinds may temporarily result from a slowdown in personal consumption and a widening of the trade deficit.

Nonetheless, the macroeconomic fundamentals remain robust, and thanks to the further tailwinds offered by the tax cuts and the spending bill approved by the Congress, we expect solid growth in the coming quarters. On the flip side, growth momentum in conjunction with a weaker dollar and higher energy prices has the potential to fuel inflation, especially in the near term, where the base effect might lift inflation readings closer to 3 percent by the early summer.

The shifting distribution of risks surrounding inflation has been noted by the Federal Reserve; we do not envision a dramatic turn towards a more hawkish stance, but overall economic conditions clear the path for a marginally less gradual removal of monetary accommodation.

"We have increased our growth forecasts for the euro area to 2.5 percent in 2018 and 2.0 percent in 2019 and the Swiss forecast to 2.1 percent this year. Labour markets improve in both currency areas and lay the ground for higher consumer confidence, stronger private consumption, and higher wage increases. As an example, the unemployment rate fell to 2.9 percent in Switzerland – a level lower than end 2014 before the discontinuation of the currency-floor", the report added.

Finally, the ECB decided to get rid of its easing bias in its policy statement. Given the scarcity of government bonds, strong growth, tight credit spreads and somewhat increasing inflation rates this move can be easily justified. It was not necessarily expected by markets to take place at the meeting this month but implies that the ECB will be under less pressure to adjust its communication at the April meeting.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022