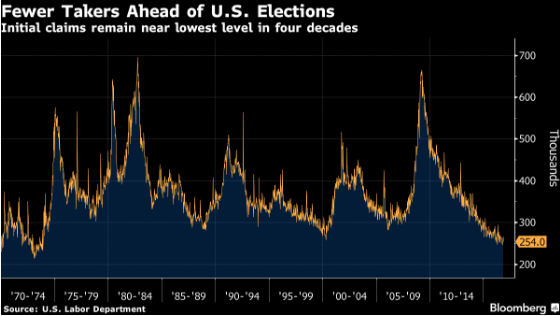

Initial jobless claims in the United States fell during the week ended Nov 5, from almost a three-month high in the run up to the country’s most impactful Presidential election concluded Nov 8, with the results being declared on the following day. Also, the fall in the number of people opting for unemployment benefits has strengthened the probability of a December interest rate hike by the Federal Reserve.

U.S.’s jobless claims fell by 11,000 to 254,000 in the week ended Nov 5, data released by the Labor Department report showed Thursday in Washington. The median forecast in a Bloomberg survey called for 260,000. Continuing claims rose, though the four-week average dropped to the lowest since 2000.

Further, filings for unemployment benefits have been below 300,000 for 88 straight weeks, the longest streak since 1970 and a level typical for a healthy labor market. Estimates in the Bloomberg survey ranged from 255,000 to 275,000. The prior week’s reading was unrevised at 265,000.

Also, the four-week average of claims, a less-volatile measure than the weekly figure, ticked up to 259,750 from 258,000 in the prior week. The unemployment rate among people eligible for benefits held at 1.5 percent.

With the recovery in economic data, the world’s largest economy is heading towards an improvement, further instigating Federal Reserve Chair Janet Yellen to call for a hike in the bank rate, with Bloomberg’s implied probability rising to 80 percent for the December case.

At 5:20GMT, the dollar index (DXY) was trading 0.09 percent down at 98.69 on the New York Stock Exchange (NYSE), while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index stood neutral at 29.5632 (lower than the range of 75-100 for bullish trend).

Also, at 5:20GMT, the U.S. benchmark S&P 500 stock index declined 0.10 percent to 2,165, compared to previous close of 2,167.25.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility