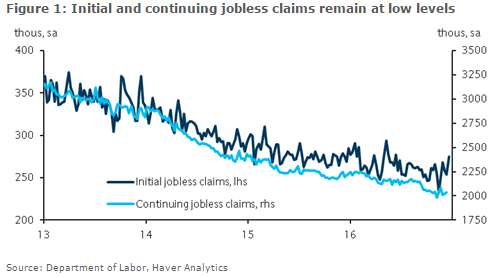

Initial jobless claims in the United States rose to 6-month high during the period of December, raising doubts over the hawkish tone delivered by Federal Rserve Chair Janet Yellen in the latest monetary policy meeting held this month. Yellen, besides, raising the Fed fund rate by 25 basis points to 0.50-0.75 percent, also added that the central bank would undertake three more rate hikes in 2017.

Initial jobless claims for the week ending December 17 rose to 275k, well above market consensus of 257k. The four-week moving average rose to 268k. The initial claims data cover the survey week for the December employment report. Continuing claims for the week ending December 10 also increased, to 2036k from an upwardly revised 2021k, data released by the Labor Department showed Thursday.

At the state level, the rise in initial claims was driven by a handful of states that registered a substantial increase. Wisconsin (2.7k), California (2.3k), Michigan and Washington (2.2k each) posted the largest increases on a seasonally adjusted basis.

Similarly, the rise in continuing claims was led by large increases in a few states, while the other states reported only modest changes. On the whole, despite today’s weaker-than-expected report, further improvement in labor market conditions can be expected through this year.

Meanwhile, the dollar index traded at 103.04, down -0.05 percent, while at 4:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at 10.40 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal