Service sector growth in the United States rose to 1-year high during the month of October, cementing prospects of a December interest rate hike by the Federal Reserve. Survey respondents attributed the recovery in growth momentum to improving domestic economic conditions and greater consumer spending in particular.

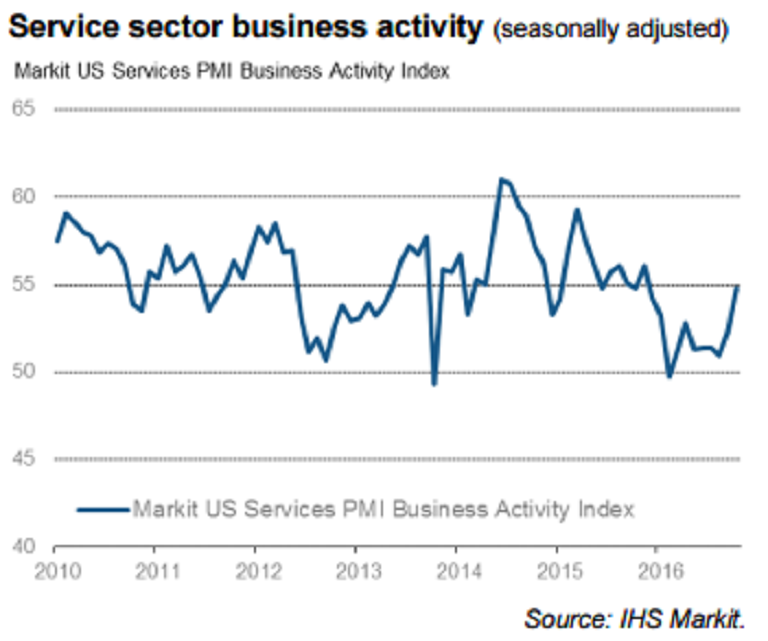

Adjusted for seasonal influences, the final Markit U.S. Services Business Activity Index registered 54.8 in October, up markedly from 52.3 in September and above the crucial 50.0 no-change value for the eighth consecutive month. Also, the seasonally adjusted final Markit U.S. Composite PMI Output Index rose to 54.9 in October, from 52.3 in the previous month.

A robust and accelerated rise in incoming new work contributed to an accumulation of unfinished business at service sector companies in October. The rate of backlog accumulation was the fastest since March 2015 and slightly stronger than the post-crisis trend.

Both the manufacturing and service sector recorded faster rates of expansion in October. Production growth across the manufacturing sector was the fastest for 12 months (output index at 55.5). Meanwhile, service providers signalled a much sharper pace of input cost inflation than the 19- month low recorded in September.

"Indications of stronger economic growth, solid job creation, rising prices and improved business confidence all pave the way for the Fed to hike interest rates again by the end of the year," said Chris Williamson, Chief Business Economist, IHS Markit.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX