There should be no doubts among anyone that the ‘trade war’ is real, and it could get infinitely worse before it gets better. With President Trump’s iron resolve on the issue, the only possible outcome is a reduction in U.S. trade deficits with the rest of the world, whether it is achieved through a trade negotiation or by the introduction of more tariffs.

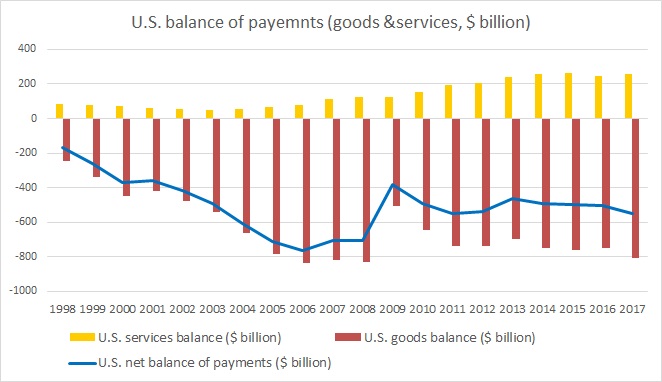

The chart shows the U.S. balance of payments with the rest of the world. According to the data from census bureau show that while the United States enjoyed $255.2 billion trade surplus in services in 2017, it ran a goods trade deficit of $807.49 billion, which gives a significant upper hand to the Trump administration in its negotiations.

Speaking at an event this week, President Trump said that while many people tried to persuade saying that in the globalized world it doesn’t matter where a product is made but stressed that it matters to him that it is produced in the U.S. with American labor.

Moreover, yesterday’s action shows that he is not only prepared for the trade war with all his available tools and he is ready to push it further. Faced with retaliation against U.S. agricultural exports from China, Mexico, and the European Union, President Trump had directed the U.S. Secretary of Agriculture Sonny Prelude to craft a short-term relief strategy targeting agricultural producers of the United States and last night announcement came from the USDA that it would authorize up to $12 billion in programs, which is in line with the estimated $11 billion impact of the unjustified retaliatory tariffs on U.S. agricultural goods.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices