There should be no doubts among anyone that the ‘trade war’ is real, and it could get infinitely worse before it gets better. With President Trump’s iron resolve on the issue, the only possible outcome is a reduction in U.S. trade deficits with the rest of the world, whether it is achieved through a trade negotiation or by the introduction of more tariffs.

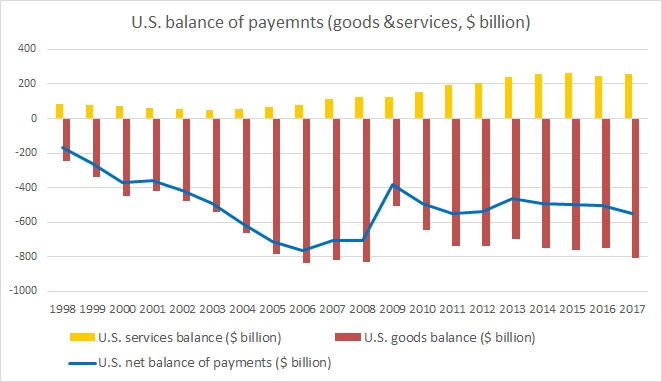

The chart shows the U.S. balance of payments with the rest of the world. According to the data from census bureau show that while the United States enjoyed $255.2 billion trade surplus in services in 2017, it ran a goods trade deficit of $807.49 billion, which gives a significant upper hand to the Trump administration in its negotiations.

Speaking at an event this week, President Trump said that while many people tried to persuade saying that in the globalized world it doesn’t matter where a product is made but stressed that it matters to him that it is produced in the U.S. with American labor.

Moreover, yesterday’s action shows that he is not only prepared for the trade war with all his available tools and he is ready to push it further. Faced with retaliation against U.S. agricultural exports from China, Mexico, and the European Union, President Trump had directed the U.S. Secretary of Agriculture Sonny Prelude to craft a short-term relief strategy targeting agricultural producers of the United States and last night announcement came from the USDA that it would authorize up to $12 billion in programs, which is in line with the estimated $11 billion impact of the unjustified retaliatory tariffs on U.S. agricultural goods.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom