Private business investment is one of the key drivers of economic growth.

Business investment in equipment (and even in buildings) drives productivity, which the Nobel Prize winning economist Paul Krugman famously observed

isn’t everything, but in the long run it is almost everything

As he put it, a country’s ability to improve its standard of living over time “depends almost entirely on its ability to raise its output per worker”.

Which is why one of the forecasts in this month’s budget stood out.

The budget forecast non-mining business investment to grow 1.5% in the coming 2021-22 financial year, after falling last year and then to jump a huge 12.5% during 2022-23.

Thursday’s capital expenditure figures released by the Bureau of Statistics are important not only because they tell us what private firms have been spending on plant and equipment and buildings and structures, but also what they are planning to spend in the months and years ahead.

The survey that points to the future

Economists like me are pretty sceptical of surveys.

We like to see what people actually do (so-called “revealed preference”), rather than what they say they intend to do (“stated preference”).

But the bureau has a decent track record with this survey. In part that’s because the people surveyed are the chief financial officers of the major firms. They tend to report what they know is in train rather than “spin” grander visions.

And they usually understate what eventually happens.

On what has actually happened, their reports suggest that private non-mining business investment bounced back 7.1% in the first three months of this year.

In the six months to March (since September) it jumped 13.8%, after falling 11.4% in the previous six months of COVID restrictions leading up to September.

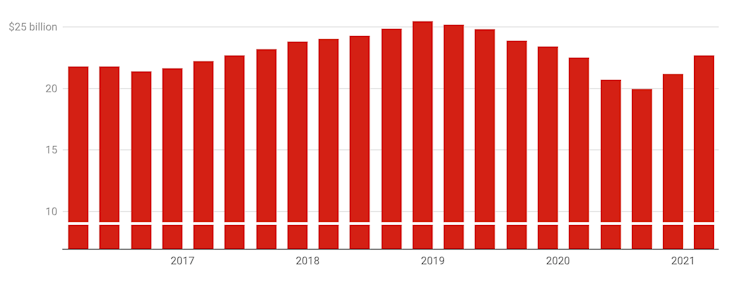

Quarterly non-mining private capital expenditure

ABS Private New Capital Expenditure and Expected Expenditure, Australia

When it comes to what lies ahead, the estimates for 2021-22 are picking up.

The March estimate is up 11.3% from the estimate made in December.

It is still well down on the latest estimate for 2020-21, about 13% down. But actual non-mining investment is usually somewhere between 30% and 50% higher than what’s expected (the bureau calculates “realisation ratios”) meaning there’s a good chance it will meet the budget forecast for 2021-22.

Whether it will make it over the much larger bar of the 12.5% increase forecast for 2022-23 is an open question.

The point is, the figures published on Thursday give us no reason for thinking it couldn’t. The Bureau of Statistics has left open the possibility of very good news.

The bounce-back in investment exceeds market expectations.

Better, and better than expected

JP Morgan reports that the consensus of forecasts was for an overall increase in investment (mining and non-mining) of 2% in the March quarter. We got 6.3%.

It matters because it tells us businesses are feeling optimistic about the future — optimistic enough to expand, notwithstanding everpresent uncertainties.

We don’t know when our international borders will reopen. We don’t know how long Melbourne’s newest lockdown will last. We don’t know whether enough Australians will be vaccinated to reach herd immunity.

And the results also matter because more business investment will be needed if we are to drive unemployment down to the government’s new (and very welcome) target of somewhere below 5%.

The extra jobs will have to come from enterprises employing more people. They won’t do it unless they think it is worthwhile to invest.

Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report

Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors

U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts

UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Tech Stocks Rally in Asia-Pacific as Dollar Remains Resilient

Tech Stocks Rally in Asia-Pacific as Dollar Remains Resilient  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth

Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Investors Brace for Market Moves as Trump Begins Second Term

Investors Brace for Market Moves as Trump Begins Second Term  Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure

Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure  Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies

Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility