Another big fight is brewing over the U.S. debt ceiling, which is a statutory limit on how much the government can borrow to pay its bills. In an interview, Senate Minority Leader Mitch McConnell said Republicans won’t agree to lift the debt ceiling in “this free-for-all for taxes and spending” environment. Congress suspended the debt ceiling in 2019 for two years, ending July 31, 2021.

The U.S. Treasury can take emergency measures that allow it to keep borrowing without an increase in the limit until as late as November. But if the ceiling isn’t raised by then, the U.S. faces either drastic across-the-board spending cuts or the prospect of an unprecedented default – with potentially dire economic consequences. Economist Steve Pressman explains why we have a ceiling – and why he thinks it’s time to abolish it.

1. What is the debt ceiling?

Like the rest of us, governments must borrow when they spend more money than they receive. They do so by issuing bonds, which are effectively IOUs with a promise to repay the money and make regular interest payments. Government debt is the total sum of all this borrowed money.

The debt ceiling, which Congress established a century ago, is the maximum amount the government can borrow. It’s a limit on the national debt.

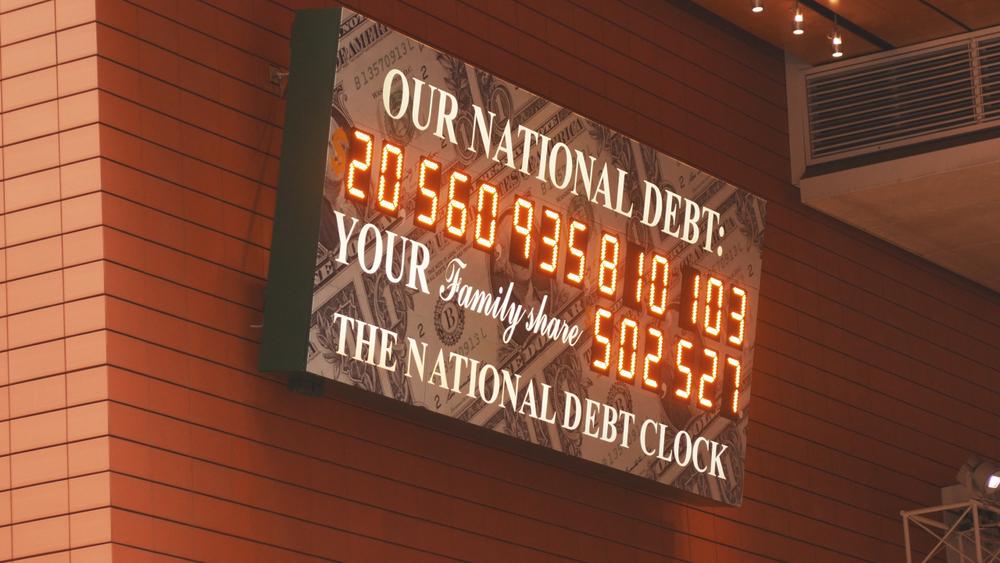

2. What’s the national debt?

Currently, U.S. government debt is $28.5 trillion, about 29% more than the value of all goods and services that will be produced in the U.S. economy this year.

Around one-quarter of this money the government actually owes itself. The Social Security Administration has accumulated a surplus and invests the extra money, currently $2.9 trillion, in government bonds. The Federal Reserve holds over $5 trillion in U.S. Treasuries.

The rest is public debt. As of May 2021 foreign countries, companies and individuals owned $7.14 trillion of U.S. government debt. Japan and China are the largest holders, with over $1 trillion each. The rest is owed to U.S. citizens and businesses, as well as state and local governments.

3. Why is there a borrowing limit?

Before 1917, Congress would authorize the government to borrow a fixed sum of money for a specified term. When loans were repaid, the government could not borrow again unless authorized to do so.

The Second Liberty Bond Act of 1917, which created the debt ceiling, changed this. It allowed a continual rollover of debt without congressional approval.

Congress enacted this measure to let then-President Woodrow Wilson spend the money he deemed necessary to fight World War I without waiting for often-absent lawmakers to act. Congress, however, did not want to write the president a blank check, so it limited borrowing to $11.5 billion and required legislation for any increase.

The debt ceiling has been increased dozens of times since then and suspended on several occasions. The last change occurred in August 2019, when Congress suspended the limit until July 31, 2021.

The new ceiling, effective Aug. 1, will become the debt outstanding at the end of July 31 – around $28.6 trillion.

4. What happens when the US hits the ceiling?

The U.S. government generally spends more than it takes in – $3.1 trillion more in fiscal 2020. Once it hits the debt limit, borrowing to make up the difference is not possible. The government can spend only its cash on hand and its tax revenues.

Treasury Secretary Janet Yellen will then have to begin using “extraordinary measures” to conserve cash. One such measure is temporarily not funding retirement programs for government employees. The expectation is that once the ceiling is raised, the government would make up the difference.

Working in Yellen’s favor is that the Treasury should have $450 billion in cash on hand at the end of July, which should last a month or so. In September, estimated tax payments from companies and individuals will be paid to the Treasury. Things then get difficult in October.

If the debt ceiling isn’t raised before the Treasury exhausts its options, decisions will have to be made about who gets paid with daily tax receipts. Government employees or contractors may not be paid in full. Loans to small businesses or college students may stop.

When the government can’t pay all its bills, it is technically in default. Some pundits have claimed that a government default would have dire economic consequences – soaring interest rates, markets in panic and maybe an economic depression.

Such fears seem overblown, primarily because once markets start panicking, Congress and the president usually act. This is exactly what happened in 2013 when Republicans sought to use the debt ceiling to defund the Affordable Care Act.

But Americans no longer live in normal political times. The major political parties are more polarized than ever.

5. Is there a better way?

The U.S. is one of few countries with a debt ceiling. Other governments operate effectively without it. America could too.

In my opinion, having a debt ceiling is dysfunctional. It makes it harder for the Treasury to pay bills when they come due.

The best solution would be to just scrap the ceiling altogether. Congress already approved the spending and the tax laws that require more debt; it shouldn’t have to approve the additional borrowing as well.

It should be remembered that the original debt ceiling was put in place because Congress couldn’t meet quickly and approve needed spending to fight a war. In 1917 cross-country travel was by rail, requiring days to get to Washington. This made some sense then. Today, when Congress can vote online from home, not at all.

This is an updated version of an article originally published on July 18, 2019.

Steven Pressman does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Steven Pressman does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns