World’s biggest Pension fund, Japan’s GPIF could be in troubled water this year and that is due to its venture to riskier assets back in 2014, when Bank of Japan (BOJ), increased its monetary stimulus by another ¥10 trillion per annum. This year BOJ introduced further stimulatory measures such as introduction of negative rates, for first time in its history, but the reactions haven’t been as intended so far.

Nikkei’s underperformance:

- While S&P 500 recovered from its January, February losses and now positive for the year, Japan’s benchmark stock index, Nikkei 225 is still down about 9.5% for the year. Even some emerging markets like India is much better performer, which is down just -2.3% YTD.

GPIF asset shift –

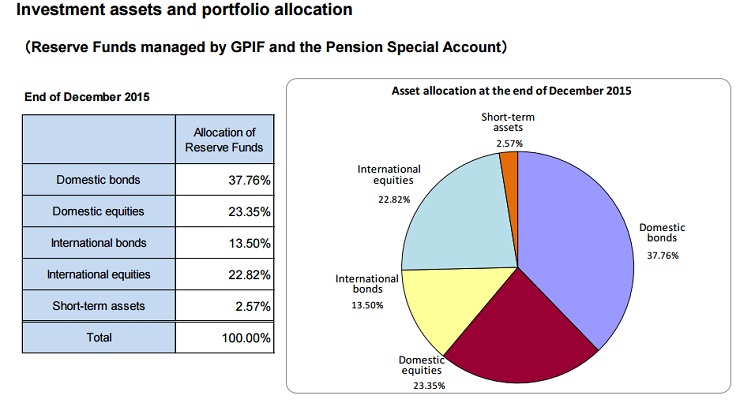

- Back in December, 2013, approximately 62.5% of the assets were consisted of bonds, while little more than 15% were invested in international stocks and 17.2% in domestic stocks.

- By third quarter of 2015, GPIF’s holding of bonds were reduced by approx. 14%, while that part went into equities. Now about 46.1% of the total $1.2 trillion portfolio is invested in equities, of which 245 invested in home.

Troubles since last year:

- Since last quarter peak around 21000, Nikkei is down about 19%, while bonds have rallies sharply. Moreover if GPIF increased greater portion of its portfolio to European equities for its international position, then it must be sitting on another set of large loss. European blue chip index, EuroStxx50 is down more than -6% for the year and about -17% in last 12 months. Stronger Yen since last quarter likely to deteriorate this numbers.

While large portion of this is still will be paper loss, losses in whatever forms in a pension fund is likely to be very big issue for a country, with largest share of elderly in its population.

These paper losses pose big risks for Prime Minister Shinzo Abe, which is facing election in upper house in summer and GPIF will be announcing the quarterly result before that.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election