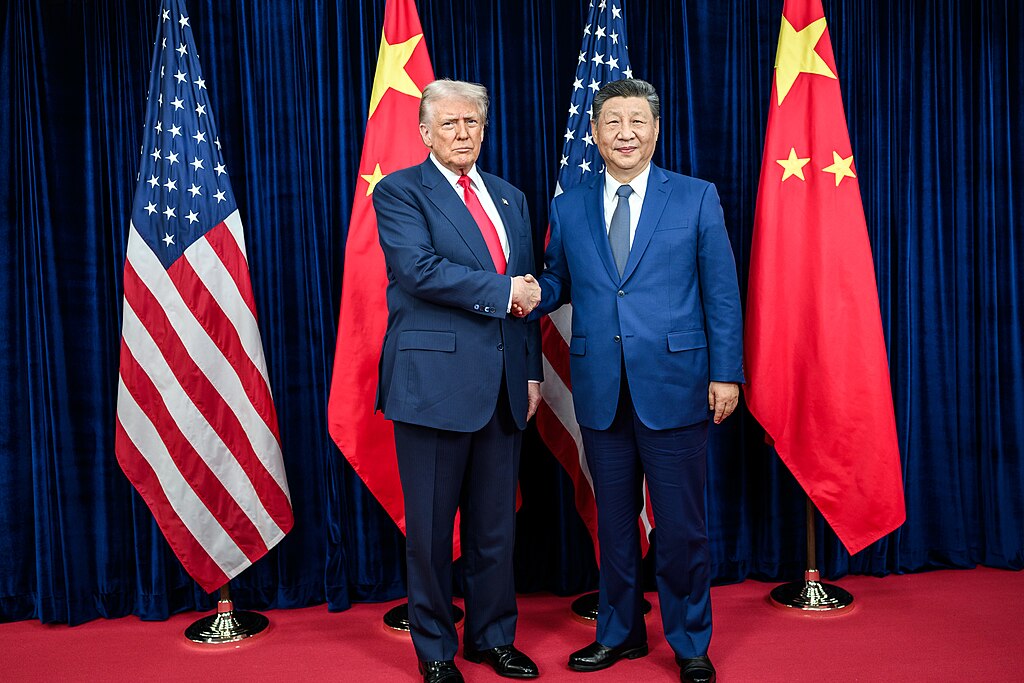

The recent meeting between Chinese President Xi Jinping and U.S. President Donald Trump provided Beijing with short-term relief, allowing it to slow the pace of economic decoupling from Washington, according to Capital Economics. While the reversal of certain U.S. tariffs offers limited immediate economic benefits, it removes the looming threat of major hikes that could have slashed China’s GDP by up to 2%.

China’s Ministry of Commerce confirmed that the U.S. has reduced tariffs on fentanyl-related products from 20% to 10% and paused its investigation into China’s shipbuilding sector. Trump also suggested a possible easing of export restrictions on Nvidia chips, though the most advanced Blackwell models remain off-limits. Julian Evans-Pritchard, Head of China Economics at Capital Economics, noted that the de-escalation “removes a key downside risk to the near-term outlook.”

The U.S. has also suspended the Bureau of Industry and Security’s entity list affiliate rule, cutting the number of Chinese firms under sanctions. In return, China agreed to boost agricultural imports from the U.S. and delay new export controls for a year. Despite these concessions, the average U.S. tariff rate on Chinese goods remains around 30%—triple the pre-Trump era level. Capital Economics estimates that rolling back part of this year’s tariff hikes could add just 0.1% to China’s GDP, as any gains may be offset by currency appreciation.

Trump hinted that a broader trade deal might be finalized during his planned Beijing visit in April 2026, suggesting ongoing efforts to stabilize relations. However, Evans-Pritchard cautioned that a renewed rupture remains possible. Even if a deal is struck, it will likely mirror the previous “Phase One” framework, focusing on trade balance rather than resolving deep geopolitical tensions. Both nations continue to pursue economic self-reliance—Washington through supply chain diversification and China through technological independence and financial autonomy.

Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies