Jul 27, 2017 10:28 am UTC| Central Banks Research & Analysis Insights & Views

The planned US sanctions against Russia mark a new low in the political relations between the two countries. The US legislation projects new sanctions against state-owned Russian companies in the mining, metal, shipping...

ECB’s Nowotny unveils probable tapering path

Jul 27, 2017 09:51 am UTC| Commentary Central Banks

Austrian central bank governor, a prominent member of the European Central Banks (ECB) governing council, Ewald Nowotny signaled how the central bank might approach a reversal in its easy monetary policy under which the...

FxWirePro: Fundamental drivers and valuations of USD/JPY

Jul 27, 2017 08:26 am UTC| Central Banks Research & Analysis Insights & Views

The US Fed left policy unchanged yesterday evening, as expected, but the accompanying statement did express more concern about the recent softness in prices. The FOMC statement seems to have been the trigger rather than...

Fundamental Evaluation Series: Long-term yield spread vs. EUR/GBP

Jul 26, 2017 11:54 am UTC| Commentary Economy Central Banks

This chart shows the performance of EUR/GBP exchange rate in contrast to the performance of long-term yield divergence between 10-year German Bund and 10-year UK gilt. During our evaluation period beginning August...

Jul 26, 2017 11:33 am UTC| Central Banks Research & Analysis Insights & Views

Brazilian central bank is lined up to announce its monetary policy today, following its last rate meeting in late May the Brazilian central bank had signaled that future rate hikes might happen in smaller steps. This more...

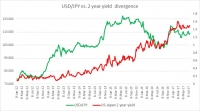

Fundamental Evaluation Series: USDJPY vs. yield divergence

Jul 26, 2017 11:07 am UTC| Commentary Economy Central Banks

This one pair has been at odds with yield divergence throughout early 2016 as the yen benefited from risk aversion and due to market participants doubts on BoJs abilities to ease policies further. It had shown...

Fundamental Evaluation Series: GBP/USD vs. short-term yield divergence review

Jul 26, 2017 11:01 am UTC| Commentary Economy Central Banks

The chart above shows, how the relationship between GBP/USD and 2-year yield divergence has unfolded since 2012. The cozy relationship between the yield spread and the exchange rate, in this case, is quite visible. Back...

- Market Data