Lowe makes the case for 'good' government debt

Sep 22, 2016 22:46 pm UTC| Insights & Views Economy Central Banks

Vital Signs is a weekly economic wrap from UNSW economics professor and Harvard PhD Richard Holden (@profholden). Vital Signs aims to contextualise weekly economic events and cut through the noise of the data impacting...

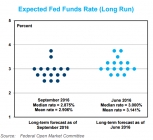

Dollar likely to grind lower as Fed cuts rate forecasts again

Sep 22, 2016 12:34 pm UTC| Commentary Central Banks

The United States dollar is likely to keep sliding lowerlike we mentioned before that one hike even if it had come yesterday, wouldnt have been enough to keep fuelling the rise of the dollar. Since late 2014, The Federal...

Central Bank of Turkey cuts key rate by 25bps, to maintain cautious monetary policy stance

Sep 22, 2016 12:32 pm UTC| Commentary Central Banks

The Central Bank of Turkey lowered its overnight lending rate by 25 basis points during its meeting today in an attempt to stimulate the ailing economy. The Monetary Policy Committee decided to lower the overnight lending...

FxWirePro: Yellow metal plays safe haven cards as FOMC tiptoes hiking expectations to Christmas

Sep 22, 2016 12:27 pm UTC| Central Banks Technicals

As expected by the majority of analysts the Fed did not raise interest rates last night. As a result, it, therefore, seems to make sense that investors seeking after safe avenues of investments in Gold, evidently this...

Janet Yellen responses firmly to Trump’s criticism of Fed

Sep 22, 2016 11:59 am UTC| Commentary Central Banks

Republican Presidential nominee Donald Trump, for some time now, has been accusing the U.S. Federal Reserve of creating a false economy with lower interest rates. Trump has said that Chair Yellen should be ashamed of what...

U.S. presidential election may provide the Fed excuse to hold off rate hike at Nov meeting

Sep 22, 2016 11:56 am UTC| Insights & Views Central Banks

The FOMC left the Fed Funds Rate unchanged at 0.25-0.50 percent as widely expected by markets. The committee voted 7-3 in favour of the decision. It was the first time since September 2011 that so many members opposed the...

Philippine central bank leaves policy settings unchanged, may start hiking rates by end-Q2 2017

Sep 22, 2016 10:58 am UTC| Commentary Central Banks

As expected, the Philippine central bank, BSP, kept its policy settings unchanged. In spite of the strong growth in domestic demand, there is no risk of breaching the upper band of BSPs 2 percent to 4 percent inflation...

- Market Data