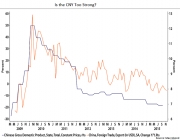

Further weakening of CNY in 2016 could prolong easing cycles of other central banks

Dec 21, 2015 11:53 am UTC| Insights & Views Central Banks

Amidst continuing concerns regarding slowing growth and weak price pressures in China, PBoC continues to guide the yuan lower vs. the USD. However, the PBoC will be keen to control the pace of addition falls in the value...

Today’s fixing indicates PBoC to take slow but steady approach

Dec 21, 2015 10:23 am UTC| Commentary Central Banks

After Peoples bank of China (PBoC) devalued Yuan for record 10th straight session on Friday, many had expected PBoC to break its record on Monday. Instead PBoC showed restrain and let the record live for at least next 11...

Dec 21, 2015 09:18 am UTC| Commentary Central Banks

Despite the global headwind the Indian economy is is continue to performing well. The economy is growing around 7.3 percent in 2015 is expected to post 7.5% growth next year. On the other hand, the inflation rate in the...

Norges Bank’s guidance signals another rate cut

Dec 21, 2015 08:20 am UTC| Commentary Central Banks

Norwegian Krone continues to trade poorly, driven by prices of crude, with EUR/NOK reaching the years high crossing 9.50 in early December and NOK/SEK falling to 23 year low. Significant easing of monetary policy...

BoI unlikely to change its existing base rate

Dec 21, 2015 06:46 am UTC| Commentary Central Banks

The central bank of Israel is expected to retain its base rate at 0.10% on its rate decision scheduled next week. The recent Fed rate hike caused the ILS to depreciate, and inflation rate is below the target at -0.9%...

Turkey's CBT likely to raise repo rate to 9.5pct by Q1 16

Dec 21, 2015 06:05 am UTC| Commentary Central Banks

The central bank of Turkey is likely to hike its bank rate in order to balance the interest rate differential caused by recent rate hike by the U.S. Fed. The CBT increased remuneration on FX required reserves by 25bp last...

Banxico likely to deliver two more rate hikes in near future

Dec 21, 2015 05:23 am UTC| Commentary Central Banks

Last week, the central bank of Mexico its bank rate by 25bps in order to protect the MXN. The country is suffering from a lower inflationary pressure as it reached to a historical low, therefore, the Banxico is expected to...

- Market Data