Pessimistic RBA minutes halts optimistic rise in Aussie

Sep 15, 2015 12:14 pm UTC| Insights & Views Central Banks

Australian Dollars three day consecutive rise got halted by pessimistic minutes from Reserve Bank of Australia, according to whom, economic growth is running below average and downside risks have increased from overseas...

BOJ offers dollar supply operation for 9/17 - 10/1 (EST)

Sep 15, 2015 02:09 am UTC| Central Banks

The Bank of Japan said it offered dollar supply operation in an agreement starting on 9/17 and ending on 10/1 (EST) with loan rate at 0.690 percent. Amount of BOJs dollar supply operation is unlimited within the...

Minutes of the Monetary Policy Meeting of the Reserve Bank of Australia Board

Sep 15, 2015 01:38 am UTC| Research & Analysis Central Banks

Members Present Glenn Stevens (Governor and Chair), Philip Lowe (Deputy Governor), John Akehurst, Roger Corbett AO, JohnEdwards, Kathryn Fagg, Heather Ridout AO and Catherine Tanna Nigel Ray (Deputy Secretary,...

RBA September Minutes: Weak Q2 growth expected, will review upcoming data to judge appropriate rates

Sep 15, 2015 01:35 am UTC| Central Banks

Appropriate to leave rates unchanged at sept 1 meeting Despite improving labour demand, spare capacity and wage pressures still weak Growth expected to stay below average, but members saw improvement in recent...

BoJ Preview: Assessment of downside risks is key

Sep 14, 2015 15:03 pm UTC| Commentary Central Banks

The Bank of Japan (BoJ) will hold a Monetary Policy Board meeting on 15-16 September. Although the BoJ should be mindful of some disappointing data inJuly (eg, industrial production), one months data will likely not be...

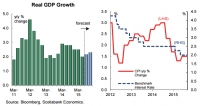

Australia's growth to expand this year, monetary conditions to remain accommodative

Sep 14, 2015 11:40 am UTC| Insights & Views Central Banks

The Reserve Bank of Australia remains optimistic about prospects for the economy. The central bank said last week that both record-low interest rates and a weaker Australian dollar were helping to support modest growth....

RBA Governor testifies on monetary policy

Sep 13, 2015 22:14 pm UTC| Commentary Central Banks

The RBA Governor testifies on monetary policy and the economic outlook before the House Standing Committee on Economicson Fridaymorning in Canberra, not long after the Federal Reserve announces its decision on interest...

- Market Data