Commodities snapshot (precious & industrial)

May 21, 2018 13:08 pm UTC| Commentary

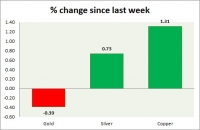

The metal pack is down today. The performance this week at a glance in chart table - Gold: Gold declining sharply as risk aversion eased and dollar recovers. Todays range $1281-1292 Gold is currently trading at...

May 21, 2018 13:05 pm UTC| Commentary

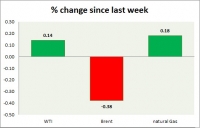

Energy pack is mixed in todays trading. Weekly performance at a glance in chart table, Oil (WTI) Oil price remains elevated as President Trump moves the U.S. out of the Iran deal. However, struggling as the...

Currency snapshot (commodity pairs)

May 21, 2018 13:01 pm UTC| Commentary

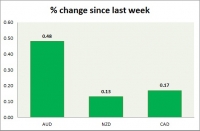

Dollar index trading at 93.74 (+0.04%) Strength meter (today so far) Aussie +0.48%, Kiwi +0.13%, Loonie +0.17% Strength meter (since last week) Aussie +0.48%, Kiwi +0.13%, Loonie +0.17% AUD/USD Trading at...

Currency snapshot (major pairs)

May 21, 2018 12:55 pm UTC| Commentary

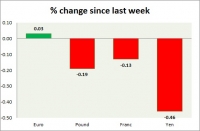

Dollar index trading at 93.77 (+0.08%) Strength meter (today so far) Euro -0.27%, Franc +0.15%, Yen -0.10%, GBP -0.34% Strength meter (since last week) Euro -0.27%, Franc +0.15%, Yen -0.10%, GBP -0.34% EUR/USD...

May 21, 2018 12:42 pm UTC| Digital Currency Insights & Views Commentary

Lets just refresh our memories on a few critics, a few months ago JP Morgan chief, Mr. Jammie Dimon, has long been an ardent critic of bitcoin. But for now, institutional money seems to be flowing in Crypto Avenue,...

FxWirePro Call Review: Book partial profits as Dollar index reaches target; target extended further

May 21, 2018 12:42 pm UTC| Commentary

In our call review in April, https://www.econotimes.com/FxWirePro-Call-Review-USD-trapped-in-Bull-Bear-tug-of-war-bears-eye-2-percent-decline-bulls-target-more-than-3-percent-1264126 we suggested that USD is trapped in a...

Fundamentals to watch out for this week

May 21, 2018 12:32 pm UTC| Commentary Central Banks

In terms of volatility risks, this week is relatively light both in terms of data and events. What to watch for over the coming days: Central Banks: Several speakers from U.S. Federal Reserve this week;...

- Market Data