FxWirePro: Key charts explaining crude oil inventories and production report of EIA

Jul 11, 2019 09:39 am UTC| Commentary

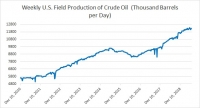

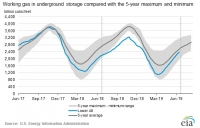

Here are some key charts based on data from the United States Energy Information Agencys (EIA) latest report that explains the level of inventories, refinery demand, and production. Chart 1 shows crude oil production...

FxWirePro: U.S. Natural gas inventory preview

Jul 11, 2019 09:01 am UTC| Commentary

Natural gas is currently trading at $2.45 per MMBtu. Key factors at play in the natural gas market The price has succumbed to the broader downtrend, which is targeting $1.6 per MMBtu. Supply bottlenecks remain...

BOC monetary policy decision: Assessing future bias

Jul 11, 2019 08:46 am UTC| Commentary Central Banks

Bank of Canada (BOC) at yesterdays meeting kept policy rate unchanged at 175 bps. The central bank recently signaled pause after increased rates five times since 2017 of 25 bps each. The overnight lending rate is at 175...

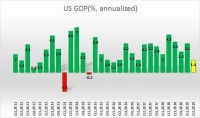

FxWirePro: Weak ‘GDPNow’ forecast casts shadow over President Trump’s ‘greatest economy ever’

Jul 11, 2019 06:55 am UTC| Commentary Economy

President Trump may continue to tout his economic performance and calling the current state of the economy as the greatest ever. If the unemployment rate is the only measure, then this might truly be the greatest U.S....

Global Geopolitical Series: ‘Special Relation’ sours with UK ambassador Darroch shown exit

Jul 11, 2019 06:00 am UTC| Commentary

Last month, during his state visit to the United Kingdom, President Trump hailed the special relationship/bond between the UK and the United States, and everyone was thinking that the relationship, which has been in...

U.S. 2-10Y yield likely to re-steepen in response to upcoming Fed rate cuts, says Scotiabank

Jul 11, 2019 05:49 am UTC| Commentary Economy

The United States 2-10Y UST yield will re-steepen with a high probability in our view, a typical and natural response to upcoming Fed rate cuts. At the initial stage, the insurance rate cuts should weigh on the USD versus...

Australian bonds tad higher after Powell speaks of 'appropriate' measures amid low inflation

Jul 11, 2019 05:03 am UTC| Commentary Economy

Australian government bonds remained tad higher during Asian trading session Thursday tracking a similar movement in the U.S. Treasuries after Federal Reserve Chair Jerome Powell put out a dovish testimony in front of the...

- Market Data